Oil major joins others in defying volatile energy prices

- BP reports higher-than-expected annual profit

- Buyback increased to $1.75 billion

- Results dropped from previous year’s record highs

- Oil majors show resilience despite volatile energy prices

- Shell, Exxon, and Chevron also post healthy profits

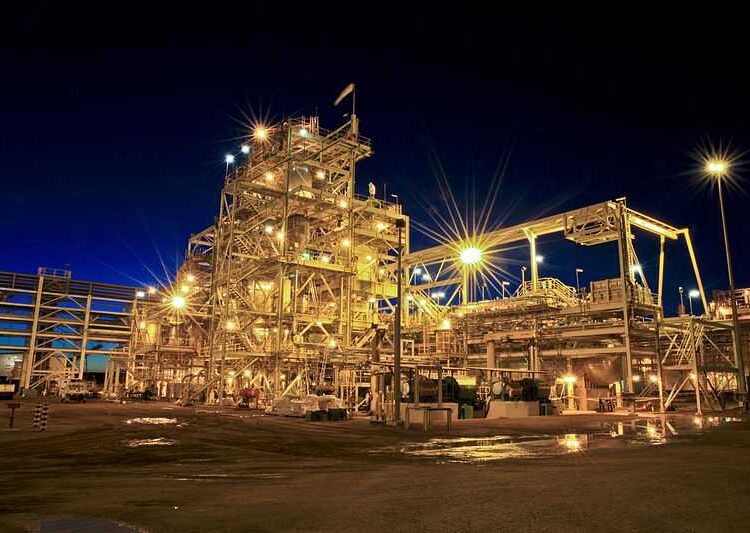

BP has announced a higher-than-expected annual profit and increased its buyback, demonstrating resilience in the face of volatile energy prices. The British energy major reported $13.84 billion in full-year underlying replacement cost profit, down from the previous year’s record highs. However, the result still exceeded expectations. Other oil-and-gas giants, including Shell, Exxon, and Chevron, have also posted healthy profits despite the challenging market conditions. BP’s quarterly profit of $2.99 billion was slightly lower than the preceding quarter but surpassed consensus forecasts. The company remains committed to its strategy of becoming an integrated energy company and investing in low-carbon activities. BP intends to buy back $1.75 billion worth of shares in the first quarter and aims for a total of $3.50 billion in the first half of the year.

Public Companies: BP (BP), Shell (Shell), Exxon (Exxon), Chevron (Chevron)

Private Companies:

Key People: Murray Auchincloss (Chief Executive), Bernard Looney (Former Boss), Michael Hewson (CMC Markets Analyst)

Factuality Level: 7

Justification: The article provides information about BP’s increased buyback and higher-than-expected annual profit, as well as the reasons for the drop in profit compared to the previous year. It also mentions the performance of other oil-and-gas giants and provides some context on the industry’s volatile energy prices. The article includes quotes from BP’s Chief Executive and mentions the company’s strategy to become an integrated energy company. However, the article lacks specific details and analysis on BP’s performance and strategy, and it does not provide a balanced perspective by including any potential challenges or criticisms.

Noise Level: 6

Justification: The article provides information on BP’s increased buyback and higher-than-expected annual profit, as well as the performance of other oil-and-gas giants. It mentions the factors that contributed to BP’s profit drop from the previous year and compares it to the performance of Shell, Exxon, and Chevron. The article also discusses BP’s strategy to become an integrated energy company and the speculation surrounding a change in direction. It provides details on BP’s plans for share buybacks and dividends, as well as its expectations for future production. Overall, the article stays on topic and provides relevant information, but lacks in-depth analysis and actionable insights.

Financial Relevance: Yes

Financial Markets Impacted: The article provides information on BP’s increased buyback and higher-than-expected annual profit. This may impact the financial markets and investors interested in the oil and gas industry.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article primarily focuses on BP’s financial performance and strategic plans, without mentioning any extreme events or their impacts.

www.marketwatch.com

www.marketwatch.com