Pharma Firm’s ADS Sale Boosts Stock Price by 14%

- Centessa Pharmaceuticals shares rise 14% after $225M public offering

- Clinical-stage pharmaceutical company raises funds through ADS sale

- Proceeds expected to reach $225 million

Centessa Pharmaceuticals, a clinical-stage pharmaceutical company, has seen its shares rise by 14% to $17.19 after successfully conducting an underwritten public offering of 15.3 million American Depositary Shares (ADSs), each representing one ordinary share, at $14.75 per ADS. The Boston-based firm anticipates receiving $225 million from this offering. The sale of all ADSs is expected to close on or around Monday, with an option for underwriters to purchase up to 2.3 million additional ADSs within 30 days at the public offering price, less discounts and commissions.

Factuality Level: 10

Factuality Justification: The article provides accurate and objective information about Centessa Pharmaceuticals’ stock performance and their public offering, with no signs of digressions, misleading information, sensationalism, redundancy, or personal perspective. It also includes relevant details about the company, the pricing, expected proceeds, and underwriters’ option.

Noise Level: 1

Noise Justification: The article provides only basic information about a company’s stock performance and an offering without any analysis or context on the pharmaceutical industry or implications for investors.

Public Companies: Centessa Pharmaceuticals ()

Key People: Chris Wack (Author)

Financial Relevance: Yes

Financial Markets Impacted: Centessa Pharmaceuticals stock price

Financial Rating Justification: The article discusses a public offering of shares by Centessa Pharmaceuticals, which affects the company’s stock price and raises $225 million in proceeds. This is relevant to financial topics as it impacts the company’s value and can potentially affect financial markets.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the article.

Deal Size: The deal size is $225,000,0000.

Move Size: 14%

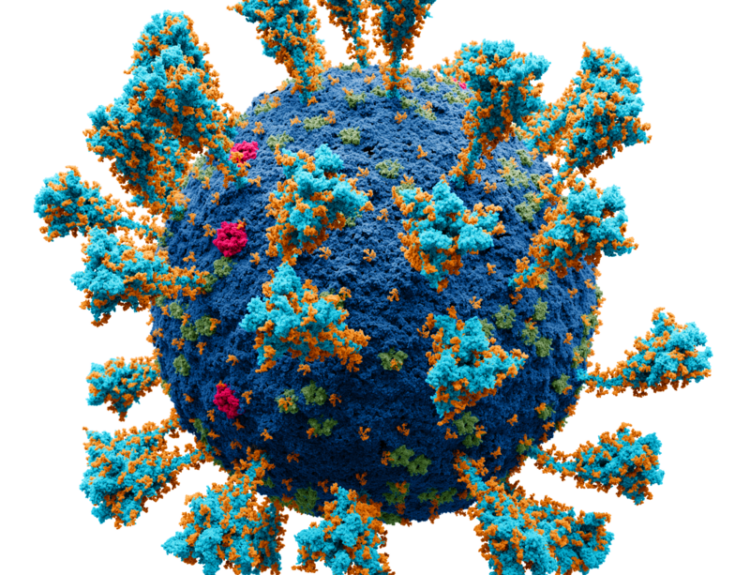

Sector: Healthcare

Direction: Up

Magnitude: Large

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com