Will $113.77bn stimulus package be enough to stabilize markets?

- China’s central bank invests $113.77 billion into stock markets

- Implementation challenges may arise

- Fund size questioned as insufficient

- Market volatility measures have not been effective

China’s central bank, the People’s Bank of China (PBOC), has pledged to invest 800 billion yuan ($113.77bn) into Chinese stock markets through new swap and loan facilities in an attempt to stabilize its economy. While analysts have welcomed this move as ‘an absolute positive’, they also highlight potential challenges that may arise during implementation, such as investors’ risk appetite and the fund’s size being only 1% of the market capitalization. The PBOC has also considered a market-stabilization fund. However, Morgan Stanley’s Laura Wang states that the rebound’s sustainability depends on breaking deflation and corporate earnings growth. Despite recent gains in stock markets, lingering economic concerns persist.

Factuality Level: 8

Factuality Justification: The article provides accurate information about China’s efforts to boost its stock markets with an investment of $113.77 billion and discusses the challenges that may arise during implementation. It also includes expert opinions from analysts and mentions the impact on stock market indices after the announcement. However, it lacks some details about the specifics of the measures and could provide more context on the underlying economic issues in China.

Noise Level: 6

Noise Justification: The article provides a good overview of China’s efforts to boost its stock markets with an $113.77 billion investment and discusses the potential challenges in implementation, such as investor risk tolerance and the size of the fund. However, it lacks detailed analysis or new insights on long-term trends or consequences of decisions on those who bear the risks. It also does not delve into antifragility or provide actionable solutions for investors.

Public Companies: Morgan Stanley (MS), Citi (C)

Key People: Laura Wang (Analyst at Morgan Stanley), Pan Gongsheng (Governor of the People’s Bank of China)

Financial Relevance: Yes

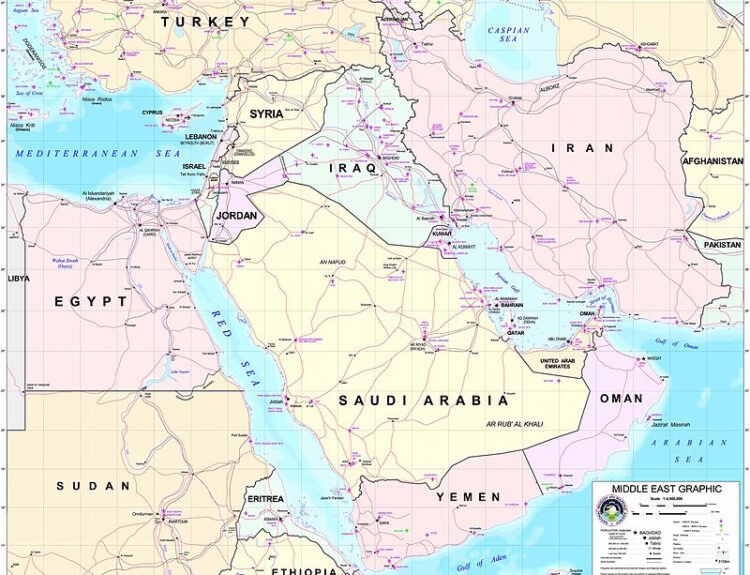

Financial Markets Impacted: Chinese stock markets, particularly the Shanghai Composite Index and Hong Kong’s Hang Seng Index

Financial Rating Justification: The article discusses China’s $113.77 billion investment into its stock markets through new swap and loan facilities, which impacted Chinese and Hong Kong stock markets, as well as the broader monetary package including changes to banks’ reserve ratio requirements.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article and it mainly discusses China’s efforts to boost its stock markets through liquidity injection and other measures.

Deal Size: The deal size mentioned in the article is $113,770,000,000.

Move Size: The market move size mentioned in the article is 1% for the benchmark Shanghai Composite Index and 0.7% for Hong Kong’s Hang Seng Index after the announcement of the stimulus package.

Sector: Technology

Direction: Up

Magnitude: Large

Affected Instruments: Stocks

www.wsj.com

www.wsj.com  www.barrons.com

www.barrons.com