Geopolitical Risks and Hurricanes Temporarily Boost Prices

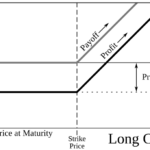

- Citigroup’s commodities team predicts a potential short-term rebound in crude oil prices due to geopolitical risks and hurricane disruptions

- Brent prices could rise to the low-to-mid-$80s, but long-term prospects remain dim

- Citi suggests short sales should price rebound is due to financial flows

- August typically sees a robust month for oil demand with consumption 1 million b/d above average

- Libya’s El Sharara field output drop and potential Iranian supply disruption from Kharg Island export terminal

- Citi maintains a bearish outlook on crude oil prices for the next 6 to 18 months

- Brent prices expected to average $60/bbl in 2025 due to demand growth stall and OPEC+ overcapacity

Citigroup’s commodities team has suggested that crude oil prices may experience a short-term rebound due to heightened geopolitical risks and potential hurricane disruptions. The bank’s analysts believe Brent prices could rise into the low-to-mid-$80s, but maintain a bearish outlook for mid- and long-term prospects. They also warn that financial positioning in Brent is light and caution about a rally built on financial flows. August typically sees strong oil demand, with consumption expected to be 1 million b/d above the 2015-2019 average. The team cites Libya’s El Sharara field output drop and potential Iranian supply disruption from Kharg Island export terminal as factors influencing prices. Despite these considerations, Citigroup expects Brent prices to average $60/bbl in 2025 due to demand growth stalling and significant OPEC+ overcapacity.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about Citigroup’s commodities team’s analysis on crude oil prices, including factors that may affect the price such as geopolitical risks, hurricane-related disruptions, oil demand, supply and output drops. It also includes expert opinions from Citi analysts on the long-term prospects of crude oil prices. The article is well-structured and relevant to the main topic without any apparent bias or personal perspective.

Noise Level: 6

Noise Justification: The article provides relevant information about Citigroup’s analysis on the commodities market and oil prices, but it lacks a more in-depth exploration of the factors affecting these markets and does not offer significant insights or solutions for readers. It also includes some irrelevant details such as mentioning the history of conflicts involving Iran and Israel.

Public Companies: Citigroup (C)

Private Companies: Oil Price Information Service,Dow Jones & Co.

Key People: Tom Kloza (Reporter), Jeff Barber (Editor)

Financial Relevance: Yes

Financial Markets Impacted: Crude oil prices and related commodities markets

Financial Rating Justification: The article discusses Citigroup’s analysis of crude oil prices, their potential impact on financial positioning in Brent, and the bank’s expectations for future price levels. This information can affect investors and traders in the commodities market, as well as companies involved in oil production and distribution.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the last 48 hours.

Move Size: No market move size mentioned.

Sector: Energy

Direction: Down

Magnitude: Large

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com