Cybersecurity Giant Outperforms Wall Street and Looks to a Brighter Future

- Cloudflare’s stock gains over 10% after beating Wall Street expectations

- Q2 loss reduced to $15.1 million from $94.5 million in the previous year

- Adjusted earnings of 20 cents a share, higher than expected

- Revenue up 30% to $401 million

- Third-quarter revenue guidance: $423-$424 million

- Full-year revenue guidance: $1.657-$1.659 billion

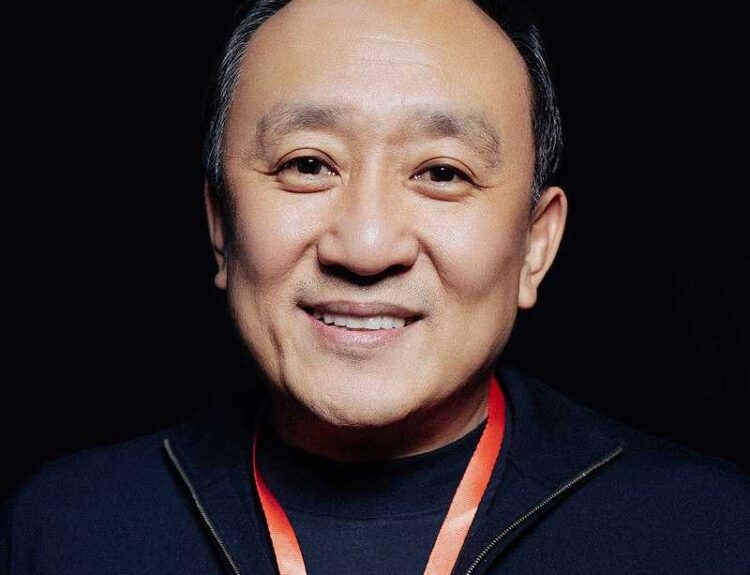

- CEO Matthew Prince credits team’s focus on execution for the results

Cloudflare Inc., a cybersecurity and software company, has reported a terrific Q2 performance, beating Wall Street’s expectations and providing better guidance for the future. The company’s stock gained over 10% in after-hours trading. Cloudflare’s Q2 loss reduced to $15.1 million from $94.5 million in the previous year, with adjusted earnings of 20 cents a share. Revenue increased by 30% to $401 million. The company expects third-quarter revenue between $423-$424 million and full-year revenue between $1.657-$1.659 billion, surpassing FactSet expectations.

Factuality Level: 10

Factuality Justification: The article provides accurate information about Cloudflare’s financial performance, including specific numbers and comparisons to expectations and forecasts. It also includes a statement from the company’s CEO, making it an objective report on the company’s financial results.

Noise Level: 3

Noise Justification: The article provides a brief summary of Cloudflare’s financial performance and guidance, but lacks in-depth analysis or context on the company’s long-term trends, antifragility, accountability, or actionable insights.

Public Companies: Cloudflare Inc. (NET)

Key People: Matthew Prince (co-founder and Chief Executive)

Financial Relevance: Yes

Financial Markets Impacted: Cloudflare Inc.’s stock

Financial Rating Justification: The article discusses the company’s financial performance, including its earnings and revenue, which can impact the stock price and investor sentiment in the financial markets.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article.

www.marketwatch.com

www.marketwatch.com