Analysts anticipate slower profit growth and potential obstacles for Coca-Cola

- Coca-Cola’s earnings growth is slowing

- Quarterly earnings report due on Tuesday

- Analysts expect slower profit growth

- Inflation and obesity drugs could impact sales

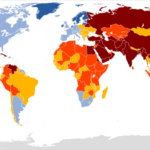

- Currency effects may continue to impact revenue growth

Challenges are mounting for Coca-Cola as Wall Street analysts predict slower profit growth in their upcoming quarterly earnings report. The consensus among analysts is that the soft-drink company will report a 3% growth in profit and a 0.4% increase in sales compared to the previous quarter. Inflation has led to higher expenses for Coca-Cola, but the company has managed to pass on most of those costs to consumers. However, as inflation cools down, higher pricing may become less effective for top-line growth. Additionally, the introduction of new obesity drugs and the impact of a stronger dollar on overseas markets could further affect revenue growth. Despite these challenges, nearly three quarters of analysts have Buy ratings on the stock, with an average price target indicating a potential gain of 7%.

Factuality Level: 3

Factuality Justification: The article provides some relevant information about Coca-Cola’s financial situation and challenges, but it contains unnecessary details and tangential information that do not contribute significantly to the main topic. The article also lacks depth in analysis and relies heavily on predictions and speculations from Wall Street analysts. There is a mix of relevant and irrelevant information, and the overall presentation is not entirely focused on providing objective and accurate information.

Noise Level: 3

Noise Justification: The article provides a detailed analysis of Coca-Cola’s challenges and financial performance, including factors affecting its revenue growth. It includes specific data and projections from analysts. However, the article lacks depth in exploring broader implications or solutions beyond financial forecasts.

Financial Relevance: Yes

Financial Markets Impacted: Coca-Cola

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article pertains to the financial performance and challenges of Coca-Cola, which is a financial company. However, there is no mention of any extreme event or its impact.

Public Companies: Coca-Cola (KO)

Key People:

Reported publicly:

www.marketwatch.com

www.marketwatch.com