Investors await key auction as yields decrease

- Bond yields continue to slide as investors await a key auction next week

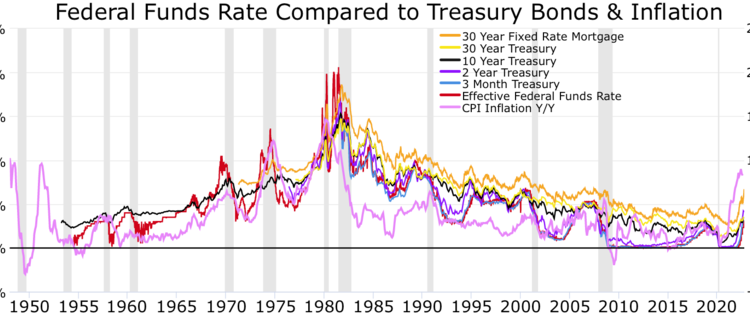

- Yields on 2-year, 10-year, and 30-year Treasuries all decrease

- Jobless claims data shows a rise, but may signal a positive message about labor market conditions in early 2024

- Other indicators suggest deteriorating activity and prices, including CPI and PPI data

- Housing starts and Federal Reserve policymakers speaking are upcoming events

- U.S. to auction $16 billion of 20-year notes on Monday

Public Companies: Walmart (WMT)

Private Companies:

Key People: Walmart’s CEO (CEO)

Factuality Level: 7

Justification: The article provides factual information about bond yields and their movement. It also mentions jobless claims data and other economic indicators. However, there is some speculation and opinion presented as quotes from strategists at BCA Research. Overall, the article provides mostly factual information with some subjective analysis.

Noise Level: 3

Justification: The article provides relevant information about bond yields and their movement. It mentions the recent data on jobless claims and the implications for the labor market. However, it lacks in-depth analysis, evidence, and actionable insights. The article also includes some unrelated information about housing starts and Federal Reserve policymakers, which is not directly related to the main topic.

Financial Relevance: Yes

Financial Markets Impacted: Bond market

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the movement of bond yields, which is relevant to financial markets. However, there is no mention of any extreme events or their impact.

www.marketwatch.com

www.marketwatch.com