High interest rates and inflation take toll on companies worldwide

- Corporate defaults at fastest pace since financial crisis

- 29 corporate defaults since the start of the year

- Uptick in European bankruptcies

- 40% of defaults in February in healthcare and media sectors

- Distressed exchanges driving defaults

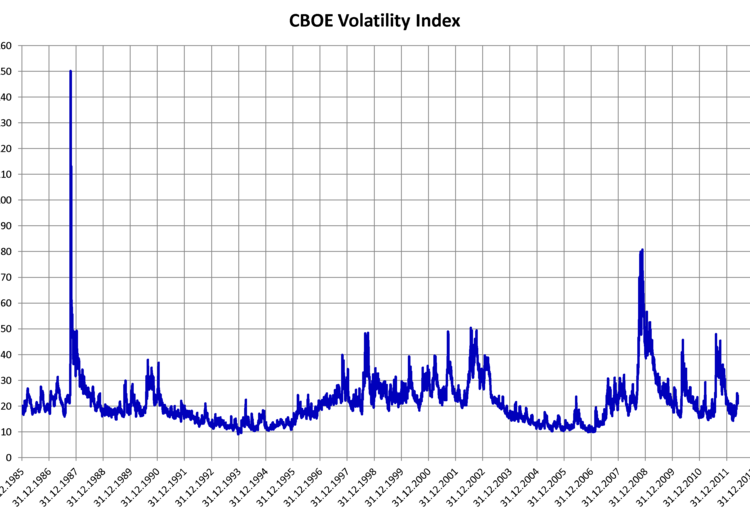

Companies around the world are defaulting on their debt at the fastest pace since the global financial crisis, according to a report from S&P Global Ratings. The number of corporate defaults has reached 29 since the start of the year, the highest tally at this point in a year since 2009. While the majority of defaults occurred in the U.S., there has been an alarming uptick in European bankruptcies. Eight European companies have already defaulted this year, more than double the number from the same period in 2023. The U.S. has seen 17 defaults, slightly less than last year. The health care and media sectors account for 40% of the defaults in February. S&P Global expects more defaults in these sectors, as well as in consumer products. Distressed exchanges have been a major driver of defaults, with 14 out of the 29 defaults involving such exchanges. This trend is reminiscent of the financial crisis in 2008. Analysts predict that European defaults will remain elevated due to a weak consumer outlook.

Factuality Level: 8

Factuality Justification: The article provides factual information about the increase in corporate defaults globally, citing a report from S&P Global Ratings. It includes specific data on the number of defaults, regions affected, sectors involved, and companies that defaulted. The information is presented objectively without sensationalism or bias. There are no significant digressions or irrelevant details that detract from the main topic.

Noise Level: 3

Noise Justification: The article provides relevant information about the increasing rate of corporate defaults globally, with specific data and examples to support the analysis. It stays on topic and does not contain irrelevant information. However, it lacks in-depth analysis of the underlying causes and potential solutions to address the issue, which could have added more value to the reader.

Financial Relevance: Yes

Financial Markets Impacted: The article indicates that companies around the world are defaulting on their debt, which can have an impact on financial markets and investors.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the increasing number of corporate defaults, which can have financial implications. However, there is no mention of an extreme event.

Public Companies: AMC Entertainment Holdings Inc. (AMC)

Private Companies: Avison Young,Apex Tool Group,Vue Entertainment International,Radiology Partners Holdings,CLISA — Compania Latinoamericana de Infraestructura & Servicios S.A.

Key People:

Reported publicly:

www.marketwatch.com

www.marketwatch.com