Futures Drop Following Political Instability in Libya and Ongoing Conflicts

- Crude oil and refined product futures fell sharply on Tuesday after a supply-driven rally

- Nymex WTI and ICE Brent crude contracts dropped in value

- Political instability in Libya contributed to the decline

- Goldman Sachs lowered its price projection for Brent by $5/bbl

- Ongoing conflicts in Middle East may not significantly impact oil prices

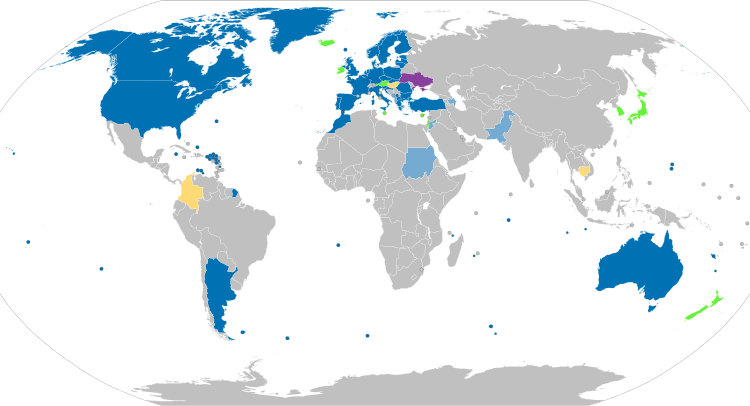

Crude oil futures experienced a sharp decline on Tuesday following a supply-driven rally, as Nymex WTI and ICE Brent crude contracts dropped in value. The political instability in Libya contributed to the drop, with concerns that it could lower the North African OPEC member’s oil production by 600,000 b/d to 900,000 b/d. Goldman Sachs also lowered its price projection for Brent by $5/bbl, indicating that the investment bank doesn’t believe an interruption in Libyan crude oil supplies will be a persistent problem. Meanwhile, ongoing conflicts between Israel and Iran-backed militant group Hezbollah, as well as intense fighting between Ukraine and Russia, may not significantly impact oil prices for now.

Image Credits: no

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about the changes in crude oil and refined product futures prices, cites a reputable source (Goldman Sachs) for its price projection, and discusses relevant geopolitical events affecting oil supply. It is well-focused on the main topic without digressions or unnecessary details.

Noise Level: 3

Noise Justification: The article provides relevant information about the fluctuations in crude oil prices due to geopolitical events but lacks a deeper analysis or contextualization of the broader implications and long-term trends.

Public Companies: Goldman Sachs (GS)

Private Companies: Oil Price Information Service,Dow Jones & Co.

Key People: Frank Tang (Reporter), Michael Kelly (Editor)

Financial Relevance: Yes

Financial Markets Impacted: Crude oil and refined product futures prices

Financial Rating Justification: The article discusses changes in crude oil and refined product futures prices, which directly impact financial markets and companies involved in the oil industry.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the last 48 hours.

Move Size: The market move size mentioned in the article is $1.30 for October Nymex West Texas Intermediate crude contracts, which decreased to $76.15/bbl.

Sector: Energy

Direction: Down

Magnitude: Large

Affected Instruments: Stocks, Commodities

www.marketwatch.com

www.marketwatch.com