Investors impressed with Bitcoin’s rally should consider these alternative options

- Some crypto stocks are outperforming Bitcoin

- MicroStrategy, Coinbase, and Grayscale Bitcoin Trust have seen significant gains

- Investing in crypto stocks provides an alternative way to play the digital asset rally

- Each crypto stock carries its own opportunities and risks

- MicroStrategy is a well-positioned pure-play on Bitcoin with billions of dollars in token holdings

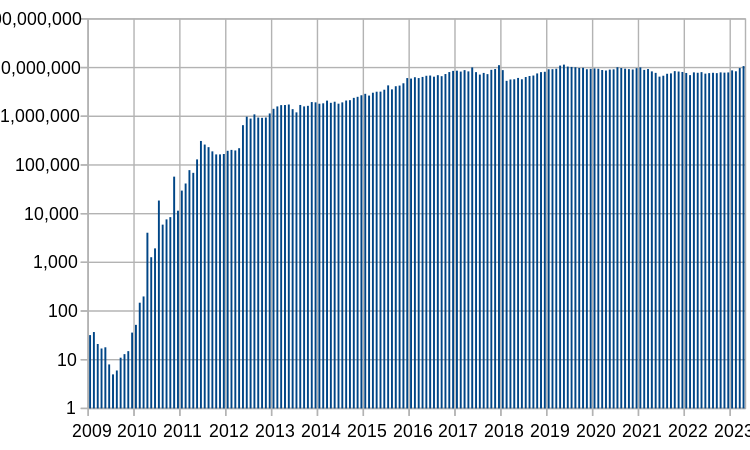

Investors looking to capitalize on the digital asset rally may want to consider investing in crypto stocks. While Bitcoin has seen a 56% surge in two months, some crypto stocks have outperformed it. MicroStrategy, a software company with significant Bitcoin holdings, has gained 71% over the same period. Coinbase Global, a crypto broker, has seen its stock rise by 83%. The Grayscale Bitcoin Trust, which holds Bitcoin passively, has risen by 68%. Additionally, some Bitcoin miners, like Marathon Digital, have seen their stock prices increase by 91%. These crypto stocks provide an alternative way to gain exposure to the crypto market, but each comes with its own opportunities and risks. For example, Coinbase is exposed to various digital assets and faces unique regulatory risks. The Grayscale fund is optimistic about the approval of spot Bitcoin ETFs, which could attract more investor interest. Bitcoin miners face challenges related to energy prices and the upcoming halving event. MicroStrategy, on the other hand, is a well-positioned pure-play on Bitcoin with billions of dollars in token holdings. The company’s CEO, Michael Saylor, is a prominent Bitcoin bull. Investing in MicroStrategy provides easy access to Bitcoin exposure without incurring fees. The company’s software business and capital markets also allow it to buy more crypto. Additionally, MicroStrategy offers downside protection and risk-management opportunities through derivatives. For investors who are hesitant about investing directly in crypto but still want exposure to the rally, MicroStrategy and other crypto stocks may be worth considering.

Public Companies: MicroStrategy (MSTR), Coinbase Global (COIN), Grayscale Bitcoin Trust (GBTC), Marathon Digital (MARA)

Private Companies:

Key People: Michael Saylor (Executive Chairman of MicroStrategy), Andrew Harte (BTIG Analyst)

Factuality Level: 7

Justification: The article provides information about the performance of Bitcoin and stocks exposed to cryptocurrency. It mentions specific stocks and their gains over a certain period of time. The article also discusses the risks and opportunities associated with investing in these stocks. While the information provided seems to be accurate, there is a lack of in-depth analysis and the article could benefit from more context and supporting data.

Noise Level: 3

Justification: The article provides relevant information about stocks exposed to Bitcoin and their performance compared to Bitcoin itself. It discusses different companies and their opportunities and risks. However, there is some repetitive information and the article lacks scientific rigor and intellectual honesty. It also does not provide actionable insights or solutions.

Financial Relevance: Yes

Financial Markets Impacted: Investors interested in Bitcoin and cryptocurrency-related stocks

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the performance of Bitcoin and stocks exposed to cryptocurrency, providing information for investors interested in the digital asset market. There is no mention of any extreme events or their impact.

www.marketwatch.com

www.marketwatch.com