Tech expenses and FX spreads impact dLocal’s earnings

- Shares of dLocal fell 25% after reporting earnings below estimates

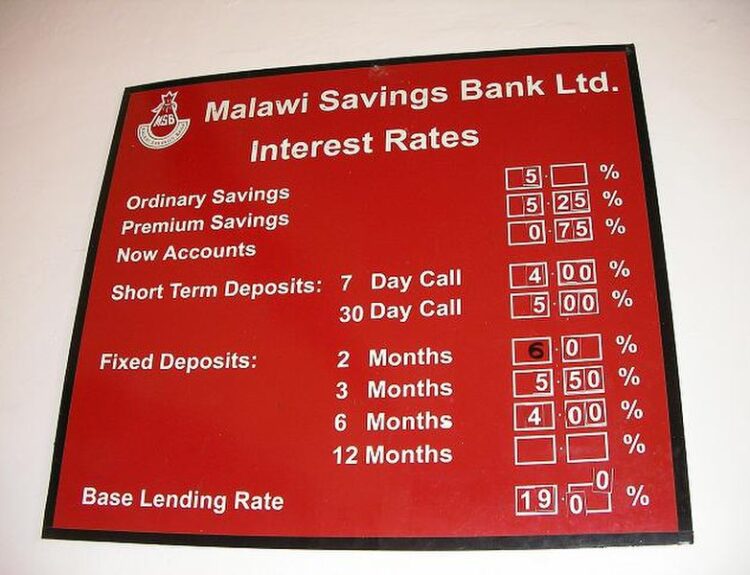

- Factors include pricing changes for a large customer, tech expenses, and tighter FX spreads in Argentina

- First-quarter earnings per share down to 6 cents from 11 cents a year earlier

- Revenue rose 34% to $184.4 million

- Total payment volume increased 49% to $5.3 billion

Shares of dLocal, a payments platform, dropped 25% to $10.10 after reporting first-quarter earnings below Wall Street estimates. The decline was attributed to several factors, including pricing changes for a large customer, technology-related expenses, and tighter foreign exchange spreads in Argentina. Earnings per share for the quarter were 6 cents, down from 11 cents in the same period last year. Despite the disappointing results, revenue increased by 34% to $184.4 million, and total payment volume saw a significant increase of 49% to $5.3 billion. The company remains in a strong liquidity position, with $212 million in available cash and $108 million in short-term investments. As a result, dLocal has authorized a stock buyback program of up to $200 million for general corporate purposes.

Factuality Level: 8

Factuality Justification: The article provides factual information about dLocal’s stock performance, earnings report, revenue, payment volume, and cash position. It does not contain any irrelevant information, misleading details, sensationalism, or bias. The information presented is clear and objective, without any obvious errors or inaccuracies.

Noise Level: 3

Noise Justification: The article provides relevant information about dLocal’s stock performance, earnings report, factors affecting the results, revenue, payment volume, and cash position. It stays on topic and supports its claims with data. However, it lacks in-depth analysis, accountability, and actionable insights.

Financial Relevance: Yes

Financial Markets Impacted: Shares of dLocal

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification:

Private Companies: dLocal

Key People: Josh Beckerman (Author)

www.marketwatch.com

www.marketwatch.com