Second Rate Hike Depends on Wage Growth, Productivity, and Profit Margins, Says Schnabel

- ECB’s Schnabel suggests caution after first rate cut in June

- Second rate cut in July not warranted, says Schnabel

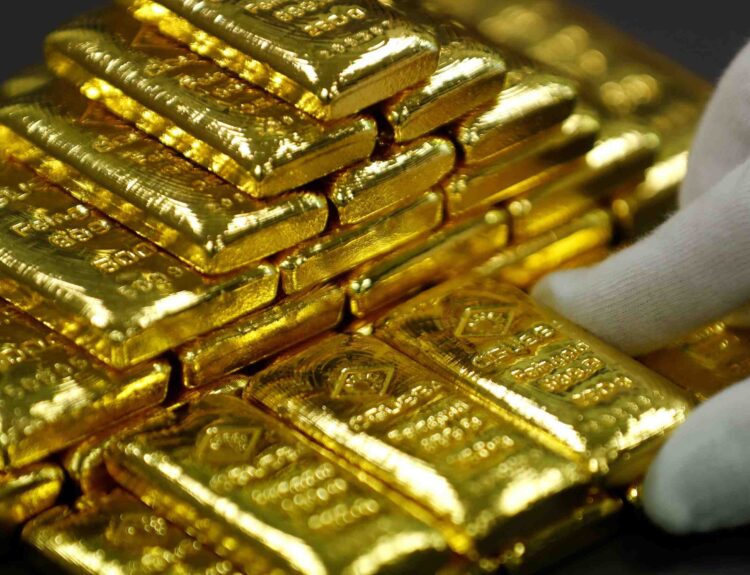

- Inflation cooling prompts ECB to lower key interest rate from 4%

- Schnabel: Future cuts depend on wage growth, productivity, and profit margins

The European Central Bank (ECB) should proceed with caution after delivering a first rate cut in June due to cooling inflation, according to Isabel Schnabel, a member of its executive board. The central bank has signaled that it is likely to lower its key interest rate from 4%. However, Schnabel stated in an interview with Nikkei that a second rate cut in July might be premature. She added that the pace of future cuts should depend on whether data shows continued easing in wage growth, a pickup in productivity, and a narrowing of profit margins. If these conditions are met, the disinflation process remains on track, and gradual easing can take place.

Factuality Level: 8

Factuality Justification: The article provides accurate information about the European Central Bank’s stance on interest rates and inflation, cites a source within the organization, and presents a balanced view without any clear signs of sensationalism or opinion masquerading as fact. However, it could be improved by providing more context and background information on the current state of the economy and the factors influencing the central bank’s decision.

Noise Level: 6

Noise Justification: The article provides relevant information about the European Central Bank’s potential interest rate adjustments but lacks in-depth analysis and actionable insights. It also contains some repetitive information and does not explore the consequences of decisions on those who bear the risks.

Private Companies: European Central Bank

Key People: Isabel Schnabel (Member of the Executive Board of the European Central Bank)

Financial Relevance: Yes

Financial Markets Impacted: European financial markets

Financial Rating Justification: The article discusses the European Central Bank’s potential interest rate changes, which can have significant impacts on financial markets and companies in the region.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the text.

www.wsj.com

www.wsj.com