Housing market picks up in January, but prices also rise

- Existing home sales rise to highest level since August

- Supply of homes on the market is increasing

- Median home price reaches all-time high for January

- Home price growth outpaces wage growth

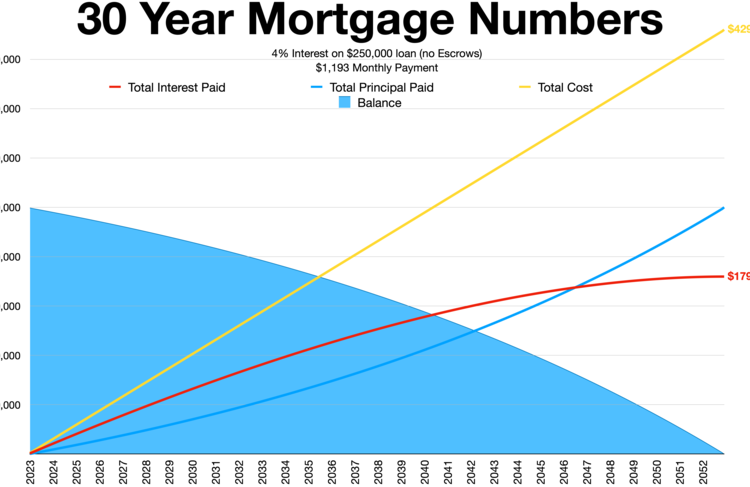

- Mortgage rates have increased recently

The housing market saw a boost in January as existing home sales reached their highest level since August. Sales rose 3.1% from the previous month, but were still 1.7% lower than the same month last year. The increase in sales is attributed to more supply and demand, with listings modestly higher and home buyers taking advantage of lower mortgage rates. However, the median home price also reached an all-time high for January, indicating a market full of multiple offers and driven by record-high housing wealth. Prospective buyers hoping for a significant easing in home affordability may be disappointed, as home price growth has outpaced wage growth. Additionally, mortgage rates have increased recently, adding to the challenges for buyers. Overall, while the housing market is showing signs of improvement, affordability remains a concern.

Factuality Level: 7

Factuality Justification: The article provides factual information about the housing market, including sales rates, home prices, inventory levels, and mortgage rates. The quotes from Lawrence Yun, the chief economist of the National Association of Realtors, add credibility to the information presented. However, the article could benefit from more context on the factors influencing the housing market trends and potential future implications.

Noise Level: 3

Noise Justification: The article provides relevant information about the housing market, including data on home sales, inventory, median home prices, and mortgage rates. It offers insights from Lawrence Yun, the chief economist of the National Association of Realtors. The article stays on topic and supports its claims with data and examples. However, it lacks in-depth analysis, antifragility considerations, and accountability of powerful people. Overall, the article is informative but could benefit from more critical analysis and exploration of long-term trends.

Financial Relevance: Yes

Financial Markets Impacted: Mortgage rates, housing market

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the housing market and mortgage rates, which are relevant to financial topics. However, there is no mention of an extreme event or its impact.

Public Companies: National Association of Realtors (N/A), Redfin (N/A)

Key People: Lawrence Yun (Chief Economist of the National Association of Realtors)

www.marketwatch.com

www.marketwatch.com