Market’s Direction Hinges on Fed’s Recession Prevention

- Fed cuts interest rates as US stocks trade near record highs

- Since 1990, rate cuts have occurred 7 times when the S&P 500 was at or near all-time highs, resulting in a median gain of 0.51% on decision day

- Six months later, stocks rose 57.1% of the time with a tepid median gain of 0.62%

- The direction of the equity market depends on whether the Fed has staved off a recession or if the rate relief came too late

- Historical data suggests mixed performance in the stock market after rate cuts

The Federal Reserve recently cut interest rates as the US stock market neared record highs, leaving investors seeking historical guidance. Since 1990, rate cuts have occurred seven times when the S&P 500 was at or near all-time highs. In these instances, stocks tended to rise on decision day (71.4% of the time) with a median gain of 0.51%. However, six months later, performance was mixed, rising 57.1% of the time with a modest median gain of 0.62%. David Rosenberg of Rosenberg Research notes that the direction of the equity market depends on whether the Fed has prevented a recession or if rate relief arrived too late. Historical data offers mixed insights into the stock market’s trajectory during easing cycles.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about the Federal Reserve’s rate cut and its historical context. It presents data on past instances of similar situations and includes expert opinions to analyze the potential outcomes. However, it does not contain any irrelevant or misleading information, sensationalism, redundancy, personal perspective presented as a fact, invalid arguments, logical errors, inconsistencies, fallacies, or incorrect conclusions.

Noise Level: 4

Noise Justification: The article provides some historical data and analysis on the relationship between rate cuts and stock market performance, but it also includes speculation about the current economic situation and potential future outcomes. While it does not dive too deeply into unrelated topics, it could benefit from more in-depth exploration of the factors influencing the current economic climate and potential consequences of the Fed’s decision.

Public Companies: S&P 500 (SPX), Dow Jones Industrial Average (DJIA)

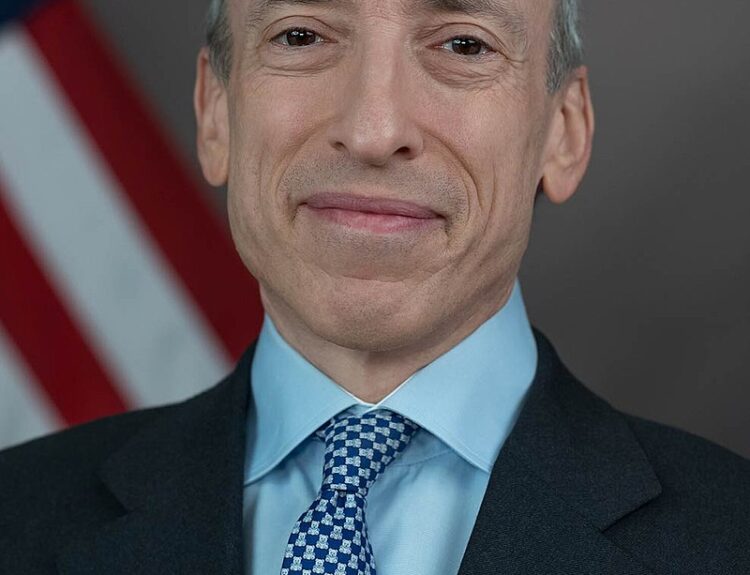

Key People: David Rosenberg (Rosenberg Research), Ken Jimenez (Contributor)

Financial Relevance: Yes

Financial Markets Impacted: U.S. stocks, S&P 500, Dow Jones Industrial Average

Financial Rating Justification: The article discusses the Federal Reserve cutting interest rates and its impact on U.S. stock markets, specifically mentioning the S&P 500 and Dow Jones Industrial Average.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the text and it does not discuss any event that happened within the last 48 hours.

Move Size: No market move size mentioned.

Sector: All

Direction: Up

Magnitude: Medium

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com