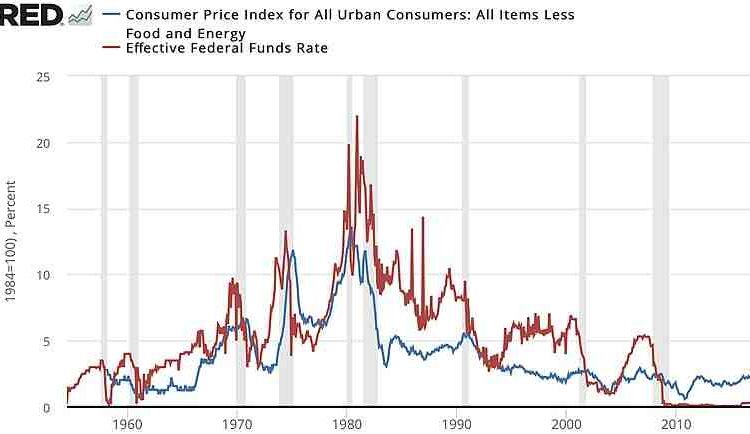

Will a bigger rate cut spook investors?

- Federal Reserve Chair Jerome Powell hints at starting interest rate cuts in September

- A 25-basis point cut is more likely than a 50-basis point cut, according to CME’s FedWatch Tool

- A larger rate cut could make investors nervous

- A measured approach may boost investor confidence

Federal Reserve Chair Jerome Powell has indicated that the central bank will start cutting interest rates, but the question remains whether a larger rate cut of 50 basis points is necessary or too risky. A 25-basis point cut is more likely, according to CME’s FedWatch Tool, with a probability of 65.5%. A bigger cut could signal that the economy needs significant help and make investors nervous. José Torres, a senior economist at Interactive Brokers IBKR, believes a measured approach would be better for investor confidence. Dave Sekera, chief U.S. market strategist at Morningstar, also thinks a 25-basis point cut is more likely and could prevent potential recession concerns.

Image Credits: no

Factuality Level: 8

Factuality Justification: The article provides relevant information about the Federal Reserve’s intentions and different opinions from experts on the potential size of interest rate cuts. It does not contain digressions or irrelevant details, nor does it present personal perspectives as facts. The reporting is accurate and objective.

Noise Level: 3

Noise Justification: The article provides some relevant information about the potential interest rate cuts by the Federal Reserve and different opinions on the size of the cut. However, it contains speculation and repetitive statements without providing much analysis or actionable insights.

Public Companies: Interactive Brokers (IBKR), Morningstar ()

Key People: Jerome Powell (Chair of the Federal Reserve), José Torres (Senior Economist at Interactive Brokers), Dave Sekera (Chief U.S. Market Strategist at Morningstar)

Financial Relevance: Yes

Financial Markets Impacted: Central bank’s interest rate decision, investors’ reactions and potential impact on stock markets

Financial Rating Justification: The article discusses the Federal Reserve’s intentions to cut interest rates and its possible impact on financial markets and investor confidence.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the last 48 hours.

Move Size: No market move size mentioned.

Sector: All

Direction: Up

Magnitude: Medium

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com