Fed Vice Chair Michael Barr praises program’s effectiveness

- Fed will let emergency loan program expire

- Bank Term Funding Program worked as intended

- Banks have $141.2 billion in loans outstanding from the program

- Extended comment period for proposed Basel III capital requirements ends on January 16

- Higher capital requirements will have a modest impact on the cost of credit

- Regulating private credit and alternative lenders is challenging

- Banking system needs regulations to ensure a strong core

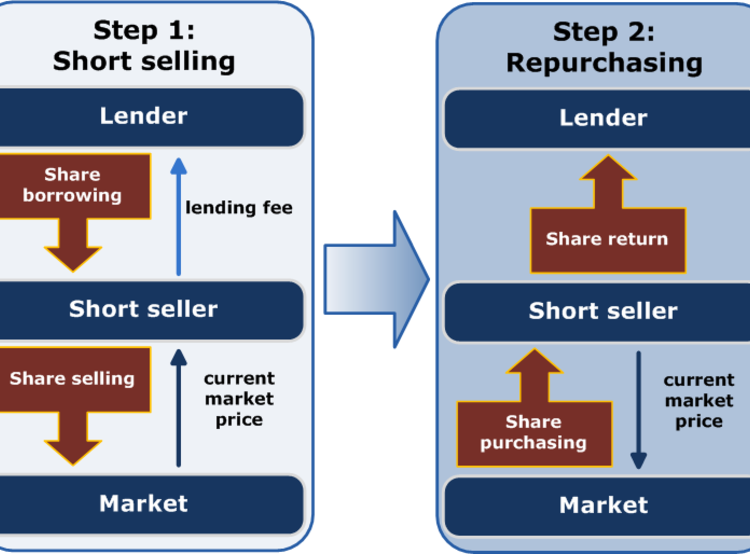

The Federal Reserve has announced that it will not extend the Bank Term Funding Program, an emergency loan program launched last year to support the banking system after the collapse of Silicon Valley Bank. Fed Vice Chairman Michael Barr stated that the program worked as intended and significantly reduced stress in the system. Currently, banks have $141.2 billion in outstanding loans from the program. The program will expire on March 11, but banks can continue to borrow and refinance loans until then. In other regulatory news, the comment period for the proposed Basel III capital requirements ends on January 16. Barr defended the higher capital requirements, stating that they would have a modest impact on the cost of credit. He also discussed the challenges of regulating private credit and alternative lenders, emphasizing the need for a strong core in the banking system.

Public Companies: Federal Reserve (null), Silicon Valley Bank (null)

Private Companies:

Key People: Michael Barr (Fed Vice Chairman)

Factuality Level: 7

Justification: The article provides information about the Federal Reserve’s decision not to extend an emergency loan program and includes quotes from Fed Vice Chairman Michael Barr. It also mentions the amount of outstanding loans from the program and the government’s backstop. However, the article lacks specific details about the collapse of Silicon Valley Bank and the proposed Basel III capital requirements. It also includes some opinion from Barr regarding the impact of higher capital requirements on loans. Overall, the article provides some factual information but could benefit from more context and clarity.

Noise Level: 6

Justification: The article provides some relevant information about the Federal Reserve’s decision not to extend an emergency loan program. However, it contains some repetitive information and lacks in-depth analysis or evidence to support its claims. The article also briefly mentions other regulatory topics without providing much detail or actionable insights. Overall, the article is somewhat informative but lacks depth and rigor.

Financial Relevance: Yes

Financial Markets Impacted: The article provides information about the Federal Reserve’s decision not to extend an emergency loan program. This decision may have implications for the banking system and potentially affect the financial markets.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses a financial topic related to the Federal Reserve and the banking system. While there is no mention of an extreme event, the decision not to extend the emergency loan program could have implications for financial markets and companies.

www.marketwatch.com

www.marketwatch.com