Central Bank Eyes Basis Trade Used by Hedge Funds

- Fed flags leverage in Treasury market as risk to financial stability

- Concerns over basis trade used by hedge funds

- Other risks include unrealized losses on securities, commercial real estate exposures, and cyber disruptions

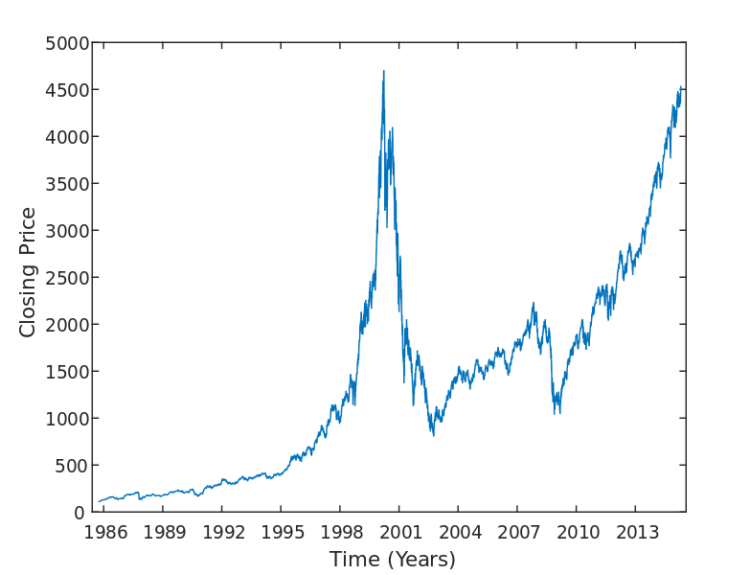

Top Federal Reserve officials have identified the use of leverage in the $27 trillion Treasury market as a potential risk to financial stability. The Fed’s July meeting minutes highlighted concerns over the basis trade, which involves taking short and long positions in Treasury futures while borrowing from the repo market for financing. This trade has been popular among hedge funds and is considered an ongoing concern by the central bank. Other risks include unrealized losses on securities in the banking system, exposures on commercial real estate, and cyber disruptions.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about the concerns of Federal Reserve officials regarding leverage in the Treasury market and its potential risks. It cites relevant sources and experts’ opinions on the matter, and discusses related financial system vulnerabilities. The article is not sensationalist or misleading, and does not include personal perspectives presented as facts.

Noise Level: 3

Noise Justification: The article provides relevant information about vulnerabilities in the financial system and discusses concerns related to leverage in the Treasury market. It also mentions ongoing discussions within the Federal Reserve and potential risks. However, it lacks a comprehensive analysis or actionable insights for readers.

Public Companies: LPL Financial (LPLA)

Key People: Lawrence Gillum (Chief Fixed-Income Strategist)

Financial Relevance: Yes

Financial Markets Impacted: Treasury market, U.S. government debt, 10-year Treasury yields, and 30-year Treasury yields

Financial Rating Justification: The article discusses the concerns of Federal Reserve officials about leverage in the Treasury market and its potential impact on financial markets and companies, as well as the monitoring of unrealized losses on securities in the banking system and exposures on commercial real estate. It also mentions the influence of leveraged positions on Treasury yields ahead of the Fed’s annual symposium.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: Minor

Extreme Rating Justification: There is no extreme event mentioned in the article, and the potential risks discussed are not severe enough to warrant a higher impact rating.

Move Size: No market move size mentioned.

Sector: All

Direction: Down

Magnitude: Large

Affected Instruments: Bonds

www.marketwatch.com

www.marketwatch.com