Lower-than-anticipated Q1 earnings impact market sentiment

- FedEx stock down due to worse-than-expected fiscal first-quarter earnings

- Adjusted earnings per share of $3.60 from sales of $21.6 billion, lower than expected

- Wall Street projected $4.75 on sales of $21.9 billion a year ago it was $4.55 per share on sales of $21.7 billion

- FedEx expects to earn between $20 and $21 a share in fiscal year 2025, down from previous range of $20 to $22 a share

- Sales growth expected to be positive again after six consecutive quarters of decline

- BofA analyst Ken Hoexter trimmed his earnings estimate for the fiscal first quarter to $4.76 a share

- FedEx aims to achieve $2.2 billion in cost savings this fiscal year

- Shares down 10.9% after results released, trading at $303.52

- S&P 500 and Dow Jones Industrial Average futures up 1.7% and 1.2% respectively

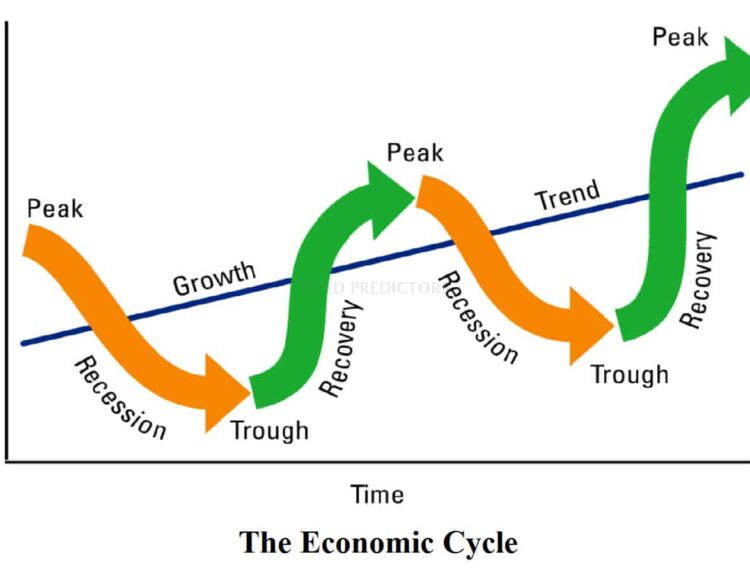

- Market boosted by Fed’s decision to cut benchmark short-term interest rates by 0.5 percentage point

FedEx stock has taken a hit following the release of its fiscal first-quarter earnings report, which showed adjusted earnings per share of $3.60 from sales of $21.6 billion – significantly lower than Wall Street’s projected $4.75 on sales of $21.9 billion. A year ago, FedEx reported earnings per share of $4.55 on sales of $21.7 billion. The company now expects to earn between $20 and $21 a share in fiscal year 2025, down from the previous range of $20 to $22 a share. Despite sales growth returning after six consecutive quarters of decline, analysts are keeping an eye on FedEx’s cost-cutting measures and the impact of a slowing economy.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about FedEx’s fiscal first-quarter earnings report, including relevant financial data and expert analysis from a BofA analyst. It also includes context on the company’s performance in previous quarters and the broader economic environment. The reporting is not sensationalized or misleading.

Noise Level: 4

Noise Justification: The article provides relevant information about FedEx’s fiscal first-quarter earnings report and includes some analysis from a BofA analyst. However, it contains some repetitive information and could benefit from more in-depth analysis of the company’s performance and industry trends.

Public Companies: FedEx (FDX)

Key People: Ken Hoexter (BofA analyst)

Financial Relevance: Yes

Financial Markets Impacted: FedEx stock

Financial Rating Justification: The article discusses FedEx’s financial performance, including their fiscal first-quarter earnings report and the impact on their stock price, which affects the company’s value in financial markets.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the text.

Move Size: The market move size mentioned in this article is 10.9%.

Sector: Technology

Direction: Down

Magnitude: Large

Affected Instruments: Stocks

www.barrons.com

www.barrons.com  www.wsj.com

www.wsj.com