Bitcoin Boosted by Fed’s Decision, Not Trump’s Actions

- Bitcoin price tops $60,000 due to the Federal Reserve’s rate cut

- Crypto traders weigh Trump’s recent crypto-related actions

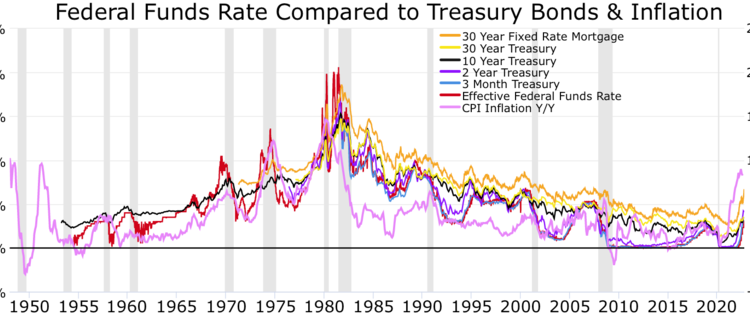

- Fed’s decision to cut rates by half a percentage point boosts Bitcoin and stock prices

- Ether climbs 4.4% to $2,429, Solana up 7.7% to $139

- Crypto stocks gain ahead of opening bell: Block, Coinbase, MicroStrategy

Bitcoin’s price surged past $60,000 due to the Federal Reserve’s rate cut, while Donald Trump’s crypto-related actions have had minimal impact on digital asset prices. The largest token by market capitalization increased by 4% to $62,465 in the last 24 hours. Despite recent flatlining, it still trades 17% below its March record high. The Fed’s decision to cut rates by half a point sparked a rally in stock prices as well. Crypto traders are also considering Trump’s launch of a platform called World Liberty Financial and his promises to build a Bitcoin reserve and replace SEC chief Gary Gensler, but analysts believe macroeconomic factors drive digital asset prices. Yuya Hasegawa from Bitbank suggests the Bank of Japan’s policy decision could influence Bitcoin’s next move. Ether climbed 4.4% to $2,429, Solana rose 7.7% to $139, and crypto stocks like Block, Coinbase, and MicroStrategy also experienced gains.

Factuality Level: 8

Factuality Justification: The article provides accurate information about the recent increase in Bitcoin’s value and its correlation with the Federal Reserve’s decision to cut interest rates. It also mentions other cryptocurrencies like Ether and Solana, as well as related stocks such as Block and Coinbase. The mention of Donald Trump’s involvement is relevant but not the main focus of the article.

Noise Level: 5

Noise Justification: The article contains some relevant information about Bitcoin’s price movement and its relation to macroeconomic factors like the Federal Reserve’s decision to cut rates. However, it also includes unnecessary details such as Donald Trump’s actions related to crypto, which may not be directly relevant to the main topic. Additionally, the mention of specific prices without context or analysis makes it less informative for readers who are not well-versed in the subject.

Public Companies: Square (SQ), Coinbase (COIN), MicroStrategy (MSTR)

Private Companies: World Liberty Financial,PubKey

Key People: Donald Trump (Former President of the U.S.), Gary Gensler (Securities and Exchange Commission Chief), Yuya Hasegawa (Analyst at Bitbank), Michael Saylor (CEO of MicroStrategy)

Financial Relevance: Yes

Financial Markets Impacted: Bitcoin, Ether, Solana, Block (Square), Coinbase, MicroStrategy

Financial Rating Justification: The article discusses the impact of the Federal Reserve’s decision to cut rates on Bitcoin and other cryptocurrencies, as well as the potential impact of the Bank of Japan’s policy meeting. It also mentions the stock prices of companies like Block (Square), Coinbase, and MicroStrategy being affected by these events.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the text.

Move Size: The market move size mentioned in the article is 4% for Bitcoin, 4.4% for Ether, and 3-4.7% for Crypto stocks like Square parent Block, major exchange Coinbase, and Michael Saylor’s Bitcoin proxy MicroStrategy.

Sector: Technology

Direction: Up

Magnitude: Medium

Affected Instruments: Stocks, Cryptocurrencies

www.barrons.com

www.barrons.com