Fed governor says more evidence needed

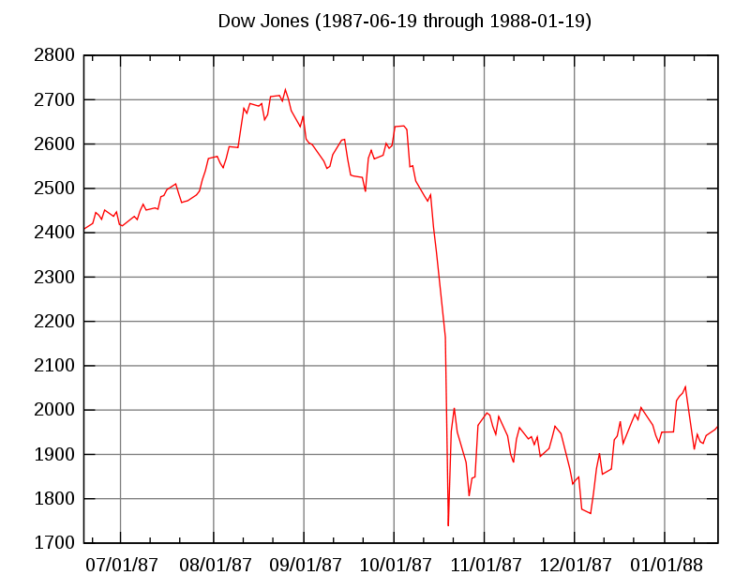

- Fed governor Chris Waller says economy is slowing

- Uncertainty about the need for more rate hikes to control inflation

- Recent signs of a slowdown could help return inflation to 2% target

Federal Reserve Governor Chris Waller has expressed concerns about the slowing economy and the uncertainty surrounding the need for further interest rate hikes to control inflation. Waller believes that recent signs of a slowdown could potentially help return inflation to the central bank’s 2% target. However, he also acknowledges that more evidence is needed to determine if additional rate hikes are necessary.

Public Companies:

Private Companies:

Key People: Chris Waller (Federal Reserve Gov.)

Factuality Level: 7

Justification: The article provides a brief statement from Federal Reserve Gov. Chris Waller regarding the economy and inflation. It does not contain any irrelevant or misleading information. However, it lacks in-depth analysis or supporting evidence for the statements made by Waller. Therefore, while the information provided is not necessarily inaccurate, it is not fully substantiated, resulting in a slightly lower factuality level.

Noise Level: 2

Justification: The article is very short and lacks substantial information. It only mentions a statement by Federal Reserve Gov. Chris Waller about a possible slowdown in the economy and its impact on inflation and interest rate hikes. However, there is no analysis, evidence, or actionable insights provided. The article is mostly filler content and does not provide any meaningful information or analysis.

Financial Relevance: Yes

Financial Markets Impacted: The article pertains to the Federal Reserve and its impact on the economy, which can have implications for financial markets and companies.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the potential impact of a slowdown in the economy on inflation and interest rate hikes, which can have implications for financial markets and companies.

www.marketwatch.com

www.marketwatch.com