New York Fed president not concerned about temporary inflation spike

- Inflation likely to slow toward 2%

- Interest rate cuts expected later this year

- Hot inflation readings in January seen as a temporary bump

- Price pressures are subsiding

- Rate of inflation using PCE index has slowed to 2.6%

- Fed wants to see more progress before cutting rates

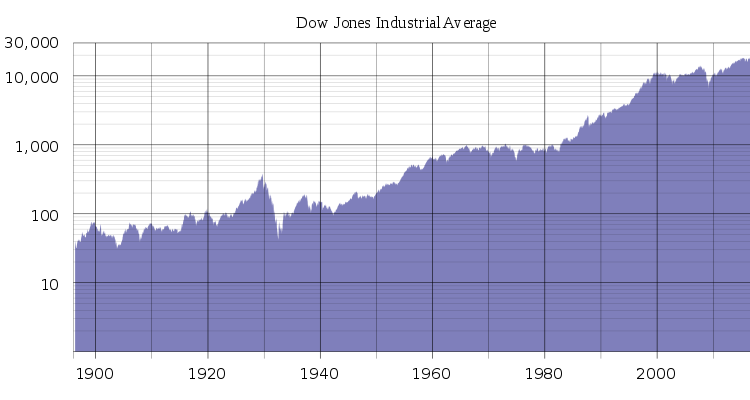

- Wall Street forecasts first rate cut in June

Inflation is expected to slow towards 2% this year, paving the way for interest rate cuts later in the year, according to the president of the New York Federal Reserve Bank, John Williams. He believes that the hot inflation readings in January are just a temporary bump and that price pressures are subsiding. The rate of inflation, measured by the Fed’s preferred PCE price index, has already slowed to 2.6% as of January from a peak of 7.1% in mid-2022. However, the Fed wants to see more progress before considering rate cuts. Wall Street now predicts that the first rate reduction will occur in June, rather than in March as previously anticipated.

Factuality Level: 2

Factuality Justification: The article is short and to the point, providing information about inflation and interest rates in the US. However, it lacks depth and context, and there are no sources cited for the information presented. The article also contains some unnecessary details and repetitions, such as the mention of the text-to-speech technology powering the feature.

Noise Level: 2

Noise Justification: The article provides relevant information about the outlook for inflation and interest rates in the U.S. It stays on topic and does not contain irrelevant or misleading information. The article supports its claims with quotes from John Williams, the president of the New York Federal Reserve Bank. However, it lacks depth in analysis, antifragility considerations, and accountability of powerful people. It also does not provide actionable insights or solutions for the reader.

Financial Relevance: Yes

Financial Markets Impacted: The article provides information on the potential reduction of U.S. interest rates, which can impact financial markets and companies.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the potential reduction in U.S. interest rates, which can have significant implications for financial markets and companies. However, there is no mention of any extreme events or their impact.

Private Companies: New York Federal Reserve Bank

Key People: John Williams (President of the New York Federal Reserve Bank)

www.marketwatch.com

www.marketwatch.com