Shares of banks and financial institutions fall as hopes of rate cuts fade

- Financials decline after Fed comments

- Shares of banks and financial institutions fall

- Federal Reserve Gov. Waller dampens hopes of extensive rate-cutting campaign

- Uncertainty remains on timing of first rate cut

- Goldman Sachs sees slight rise in shares, driven by wealth-management operations

- Morgan Stanley falls behind Goldman in latest quarter

- Increased market uncertainty due to U.S. presidential elections

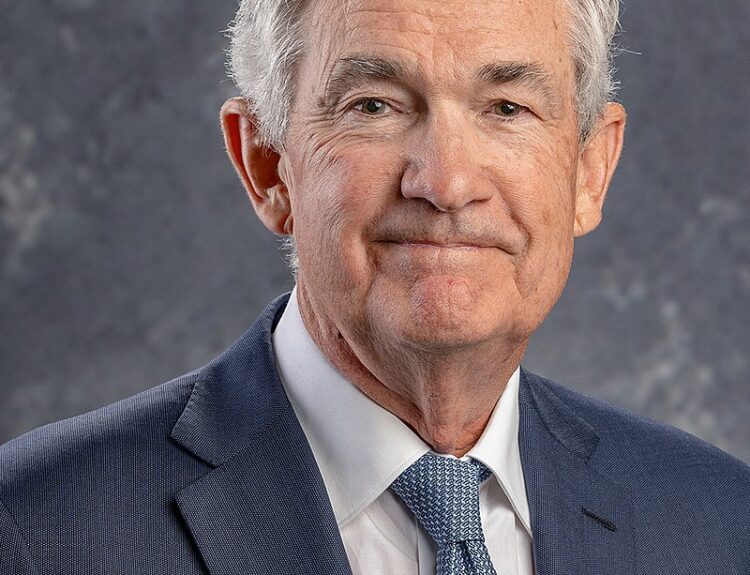

Shares of banks and other financial institutions declined after comments from Federal Reserve Gov. Christopher Waller drove up Treasury yields. Waller’s remarks dashed market hopes of an extensive rate-cutting campaign in the near future. While Fed Chairman Jerome Powell had previously signaled a more dovish stance, it remains uncertain when the central bank will make its first rate cut. Goldman Sachs Group saw a slight rise in shares, driven by strength in its wealth-management operations. However, Morgan Stanley fell behind Goldman in the latest quarter. Additionally, the upcoming U.S. presidential elections have brought increased market uncertainty as investors position their portfolios based on expectations for the next four years of shifting political winds.

Public Companies: Goldman Sachs Group (N/A), Morgan Stanley (N/A)

Private Companies:

Key People: Christopher Waller (Federal Reserve Gov.), Jerome Powell (Fed Chairman), Saira Malik (Chief Investment Officer at Nuveen)

Factuality Level: 3

Justification: The article contains some relevant information about the impact of Federal Reserve comments on the stock market and the performance of specific financial institutions. However, it also includes unnecessary background information about the Fed’s rate-cutting plans and the performance of Goldman Sachs and Morgan Stanley. The mention of the U.S. presidential elections and Trump’s victory in the Iowa Caucuses is unrelated to the main topic and adds to the digressions in the article. Overall, the article lacks focus and includes tangential details, reducing its factuality level.

Noise Level: 3

Justification: The article contains a mix of relevant information about the financial market and the performance of banks, but it also includes unrelated information about the Iowa Caucuses and the history of U.S. presidential elections. The article lacks scientific rigor and intellectual honesty as it does not provide evidence or data to support its claims. Overall, the article is somewhat noisy and lacks focus.

Financial Relevance: Yes

Financial Markets Impacted: Shares of banks and other financial institutions

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the impact of comments from Federal Reserve Gov. Christopher Waller on Treasury yields and the expectations for rate cuts. It also mentions the performance of Goldman Sachs and Morgan Stanley. While there is mention of the U.S. presidential elections, there is no extreme event described in the article.

www.marketwatch.com

www.marketwatch.com