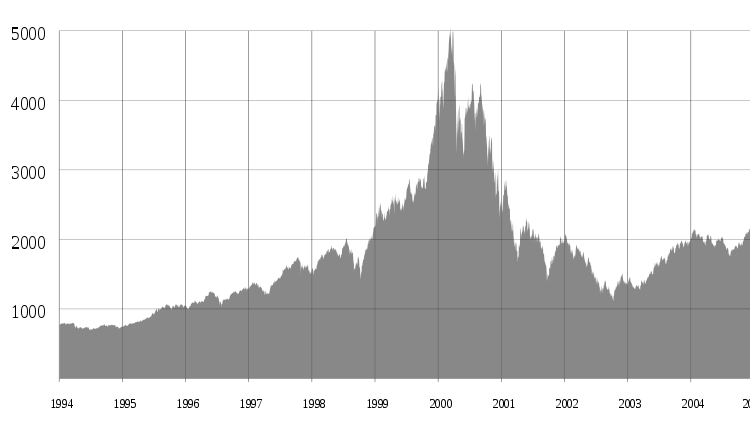

Mixed economic data and bets on rate cut drive financials higher

- Shares of banks and financial institutions rise on hopes for a Federal Reserve rate cut

- Mixed economic data shows muted jobs growth but robust services-sector growth

- Waning strength in jobs data leads to bets on Fed rate cut later this year

- Surprising increase in 10-year Treasury yield despite low inflation

Shares of banks and other financial institutions rose as hopes for a Federal Reserve rate cut remained high following mixed economic data. The latest economic signals showed muted jobs growth in a private-employers’ survey, but also a surprisingly robust reading of services-sector growth. This conflicting data has led to speculation that the Fed may still cut rates later this year. One strategist, Jim Paulsen, noted that the recent increase in the 10-year Treasury yield, which has driven mortgage rates up, is surprising given the low inflation. As real economic activity and inflation slow further, the likelihood of a significant decline in the 10-year yield is growing.

Source: https://www.marketwatch.com/story/financials-gain-on-fed-hopes-financials-roundup-879f1c88?mod=newsviewer_click

Factuality Level: 8

Factuality Justification: The article provides relevant information about the financial market’s response to mixed economic data and includes expert opinion from a Wall Street strategist. It discusses the potential for a Federal Reserve rate cut and the relationship between bond yields and inflation. While it is brief, it does not contain any major issues such as digressions, misleading information, or personal perspectives presented as facts.

Noise Level: 5

Noise Justification: The article provides some relevant information about the financial market’s reaction to mixed economic data and the possibility of a Federal Reserve rate cut but lacks in-depth analysis or actionable insights. It also contains repetitive information and does not explore the consequences of decisions on those who bear the risks.

Key People: Jim Paulsen (Wall Street strategist), Rob Curran (Author)

Financial Relevance: Yes

Financial Markets Impacted: Federal Reserve rate cut, shares of banks and financial institutions, Treasury yields, mortgage rates, bond yields

Financial Rating Justification: The article discusses the impact of economic data on financial markets, specifically the potential Federal Reserve rate cut and its effect on shares of banks and other financial institutions, as well as the relationship between bond yields and inflation.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the text.

www.marketwatch.com

www.marketwatch.com