Nvidia Earnings, Hedge Fund Changes Impact Markets

- Nvidia’s earnings report raises stakes for AI optimism

- Two Sigma founders step down amid clash

- Treasury Department extends anti-money laundering measures to investment advisers and real estate professionals

- Berkshire Hathaway reaches $1 trillion market cap

- Saudi national and Briton guilty of fraud in 1MDB case

Shares of banks and financial institutions dropped as investors awaited Nvidia’s earnings report, which has significant implications for the bull market due to its connection to artificial intelligence. The founders of Two Sigma, a $60 billion quant-trading powerhouse, stepped down in an effort to resolve a longstanding dispute that had complicated operations at the firm. The Treasury Department implemented new anti-money laundering measures for investment advisers and real estate professionals, but later eased requirements following industry feedback. Berkshire Hathaway’s stock rose, surpassing $1 trillion in market capitalization. Tarek Obaid and Patrick Mahony were found guilty of fraud and money laundering in relation to the 1MDB scandal.

Factuality Level: 8

Factuality Justification: The article provides relevant information about various financial events and news without any significant issues such as digressions, misleading information, sensationalism, redundancy, or personal perspective presented as a fact. However, it could be improved by providing more context and background information for some of the topics mentioned.

Noise Level: 6

Noise Justification: The article covers a mix of financial news and legal developments, but lacks depth or analysis on any specific topic. It includes unrelated events (Nvidia’s earnings, Two Sigma founders stepping down, Treasury Department regulation changes, Berkshire Hathaway’s market cap milestone, and the 1MDB fraud case) without providing a cohesive focus or context.

Public Companies: Nvidia (NVDA), Berkshire Hathaway (BRK.A)

Private Companies: Two Sigma

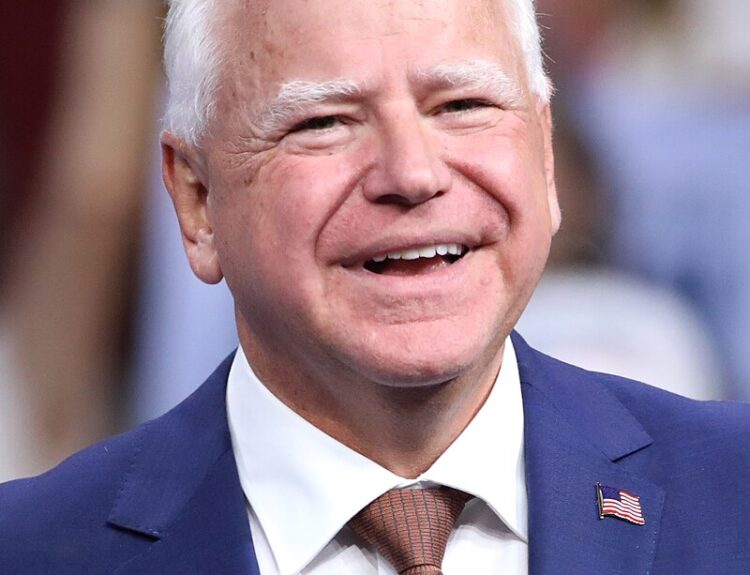

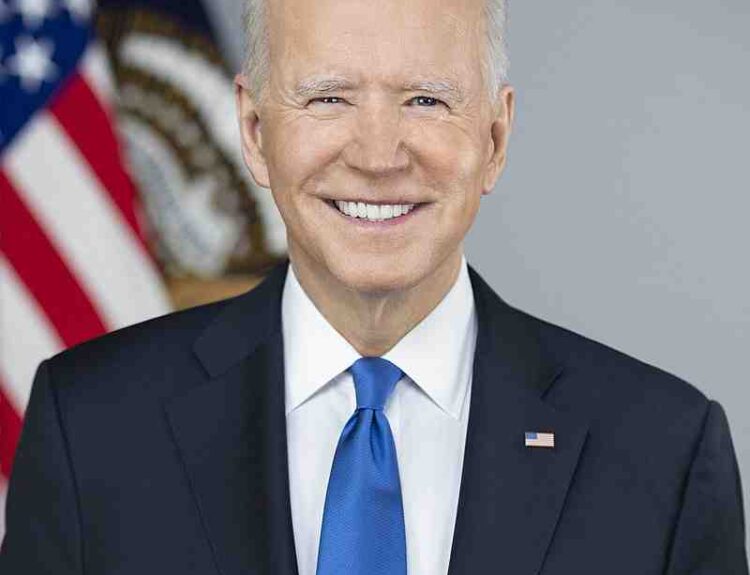

Key People: John Overdeck (Co-Chief Executive), David Siegel (Co-Chief Executive), Warren Buffett (CEO), Tarek Obaid (Defendant), Patrick Mahony (Defendant)

Financial Relevance: Yes

Financial Markets Impacted: Shares of banks and financial institutions, Nvidia, Two Sigma, Berkshire Hathaway, anti-money-laundering measures for investment advisers and real-estate professionals

Financial Rating Justification: The article discusses the impact on shares of banks and financial institutions due to Nvidia’s earnings report, changes in leadership at Two Sigma hedge fund, new Treasury Department regulations affecting investment advisers and real-estate professionals, and Berkshire Hathaway reaching a market capitalization milestone. These events all have direct relevance to the financial sector and impact various companies within it.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There are no extreme events mentioned in the text.

Move Size: No market move size mentioned.

Sector: All

Direction: Down

Magnitude: Large

Affected Instruments: Stocks

Image source: Coolcaesar / Own work

Reported publicly: www.marketwatch.com

www.marketwatch.com