Record Revenue and Net Profit Fueled by Cloud and Networking Products

- Foxconn’s second-quarter profit increased by 2.49%

- Record revenue driven by AI server demand

- Net profit reached NT$35.045 billion (US$1.08 billion)

- Quarterly revenue up 19% to a record NT$1.551 trillion

- Cloud and networking products segment contributed to growth

- Stock soared nearly 80% this year due to AI boom expectations

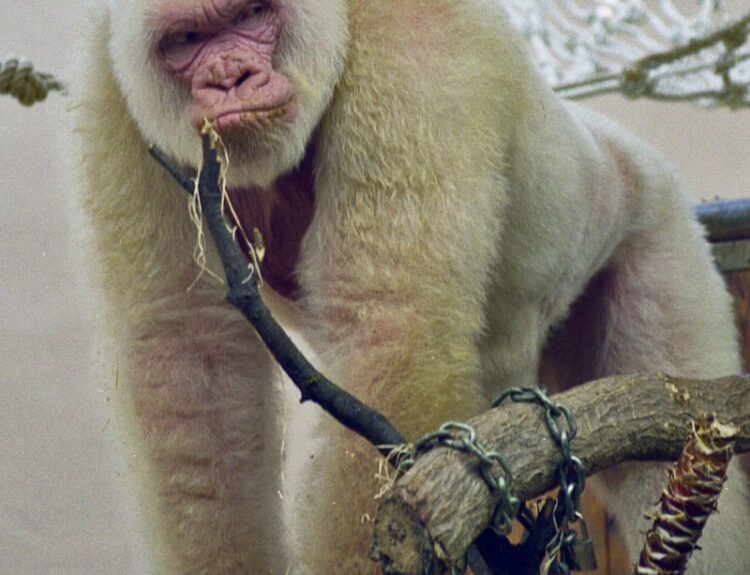

Foxconn, the world’s largest contract electronics maker known for assembling Apple’s iPhones, reported a 2.49% increase in its second-quarter net profit due to record revenue driven by strong demand for artificial intelligence (AI) servers. The Taiwanese company, formally called Hon Hai Precision Industry, has been diversifying its business lines and now plays an important role in building AI servers for US giants like Amazon and Nvidia. This led to a 80% increase in the company’s stock price this year, outperforming the broader Taiwan market with a more than 20% jump. The second-quarter net profit reached NT$35.045 billion (US$1.08 billion), surpassing analyst estimates of NT$33.73 billion.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about Foxconn’s increase in net profit and revenue, attributing it to strong demand for AI servers. It also mentions the company’s diversification efforts and its role in building AI servers for U.S. giants like Amazon and Nvidia. The stock performance is also mentioned, but without any exaggeration or personal perspective.

Noise Level: 3

Noise Justification: The article provides relevant information about Foxconn’s increase in net profit and diversification efforts, but lacks in-depth analysis or exploration of long-term trends or consequences. It also does not offer actionable insights or new knowledge for the reader.

Public Companies: Foxconn (2317), Amazon (), Nvidia ()

Key People: Sherry Qin (Writer)

Financial Relevance: Yes

Financial Markets Impacted: Foxconn’s stock price and broader Taiwan market

Financial Rating Justification: The article discusses Foxconn’s increase in net profit, its role in the AI industry, and the impact on its stock price and the broader Taiwan market, making it relevant to financial topics and financial markets.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: No extreme event mentioned in the article

Deal Size: 1080000000

Move Size: The market move size mentioned in the article is 2.49%.

Sector: Technology

Direction: Up

Magnitude: Large

Affected Instruments: Stocks

www.wsj.com

www.wsj.com