FTC Seeks to Dismantle Google’s Dominance

- FTC urges court to break up Google’s monopoly power

- Epic Games case involved

- Anticompetitive behavior accused

- Google profiting from practices

- Android app distribution monopolized

- In-app purchases targeted

- San Francisco jury ruled in favor of Epic Games in 2020

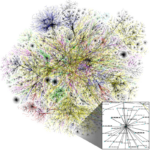

- FTC highlights digital market aspects like network effects and data feedback loops

- Google faces multiple antitrust challenges

The Federal Trade Commission (FTC) has advised a district court to use its power to break up or render impotent the monopoly power of Google in a case brought by Epic Games. The agency stated that injunctive relief should ensure the tech giant cannot continue to profit from anticompetitive behavior. In 2020, videogame maker Epic Games accused Google of using its dominant position in its Play Store to extract extra profits through practices such as monopolizing Android app distribution and in-app purchases. A San Francisco jury ruled unanimously in favor of Epic Games in December. The FTC’s brief also highlights the importance of considering aspects of digital markets like network effects and data feedback loops that help established players gain an advantage by locking in users and advertisers. This comes as Google faces multiple antitrust challenges, with a district court in Washington, D.C. finding last week that Google holds an illegal monopoly on search.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about the FTC’s stance on the case involving Epic Games and Google, as well as mentioning a related antitrust challenge in Washington, D.C. It does not include digressions or irrelevant details, nor does it present personal opinions as facts. However, it could provide more context on the specific practices that Epic Games claims are anticompetitive.

Noise Level: 3

Noise Justification: The article provides relevant information about the FTC’s stance on the case and the ongoing antitrust challenges faced by Google, but it could benefit from more in-depth analysis of the potential consequences of breaking up the company or alternative solutions to address competition concerns.

Public Companies: Google (GOOGL)

Private Companies: Epic Games

Key People:

Financial Relevance: Yes

Financial Markets Impacted: Google’s stock price and the tech industry

Financial Rating Justification: The article discusses a legal case against Google, which could impact its business practices and potentially lead to financial consequences for the company. The tech industry is also affected as it involves antitrust challenges and competition in digital markets.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the text.

Move Size: No market move size mentioned.

Sector: Technology

Direction: Up

Magnitude: Large

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com