Apparel retailer sees growth across all brands and raises guidance

- Gap’s brands posted a 3% increase in comparable-store sales, surpassing analyst expectations

- All four of Gap’s brands reported growth for the first time in a decade

- Net income was 267% higher than expected

- Gap shares jumped 20% after earnings call

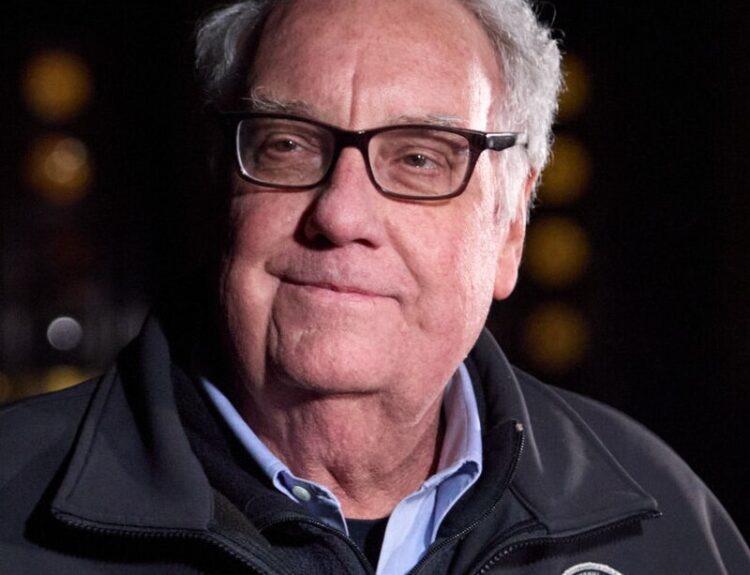

- Sales trends improved across all brands under new CEO Richard Dickson

- Operating margins have expanded for five consecutive quarters

- Inventory down 15% from last year, allowing for trend-chasing flexibility

Gap Inc.’s brands, including Gap, Old Navy, Athleta, and Banana Republic, have reported comparable-store sales growth for the first time in a decade. This comes after hiring Richard Dickson as CEO and Zac Posen as creative director. The company’s shares surged following the earnings call, with operating margins expanding for five consecutive quarters due to prudent decisions and lower commodity costs.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about Gap’s recent performance, including financial data and specific examples of successful strategies for each brand. It also includes relevant background information on the company’s leadership changes and mentions the positive impact of lower commodity costs and inventory management.

Noise Level: 3

Noise Justification: The article provides relevant information about Gap’s recent financial performance and the factors contributing to its success, such as creative leadership, product innovation, and inventory management. It also mentions the company’s improved operating margins. However, it could benefit from more in-depth analysis of long-term trends or possibilities and a broader context for comparison with other companies in the industry.

Public Companies: Gap Inc. (GPS)

Key People: Richard Dickson (Chief Executive Officer), Zac Posen (Creative Director)

Financial Relevance: Yes

Financial Markets Impacted: Gap’s stock price

Financial Rating Justification: The article discusses Gap Inc.’s financial performance, including its quarterly sales growth, net income, and guidance for the full fiscal year. It also mentions the impact on Gap’s stock price after the earnings call, indicating that the news is relevant to financial markets as it affects the company’s shares.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: No extreme event mentioned

www.wsj.com

www.wsj.com