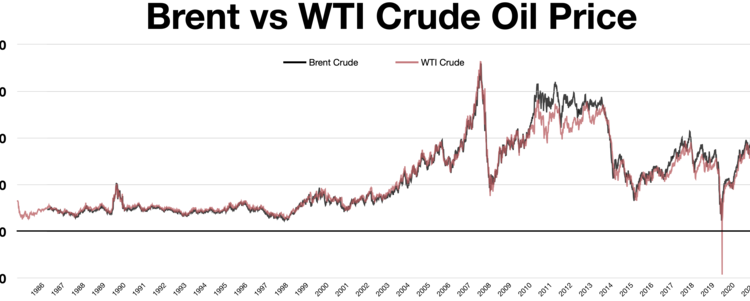

Slowing economies and higher interest rates contribute to the decline

- Global oil-demand growth expected to weaken next year

- IEA predicts demand growth to halve to 1.1 million barrels a day in 2023

- Economic growth worldwide set to slow to 2.6% in 2024

- Record supply from the U.S., Brazil, and Guyana expected to lift world output

- OPEC+ output cuts did little to prop up oil prices

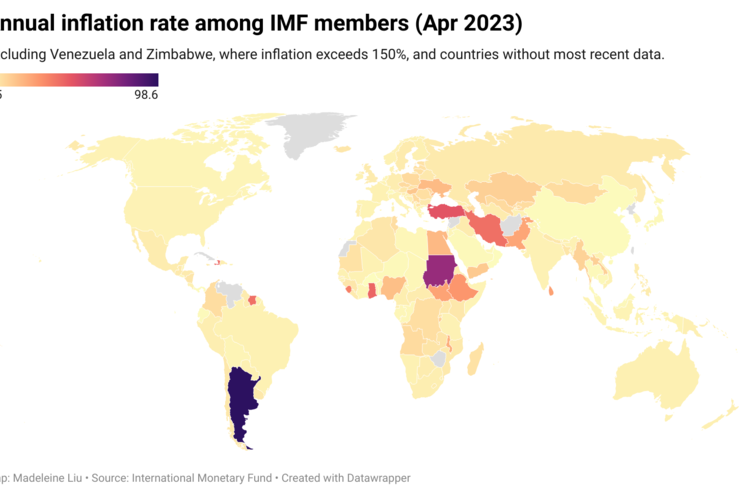

According to the International Energy Agency (IEA), global oil-demand growth is expected to weaken next year. The IEA predicts that demand growth will halve to 1.1 million barrels a day in 2023, with average demand reaching 102.8 million barrels a day. This decline in demand is a result of the slowdown in major economies due to higher interest rates. The macroeconomic climate, coupled with the fading rebound from Covid-induced lows, has led to a deterioration in oil-demand growth momentum. The IEA also lowered its oil-demand growth outlook for 2023 by 90,000 barrels a day, bringing the total demand to an average of 101.7 million barrels a day. Economic growth worldwide is expected to slow to 2.6% in 2024, with China’s growth recording a sharp decline to 4.2% from 5%. Despite voluntary output cuts by OPEC+ and its allies, oil prices have weakened significantly in recent weeks, reaching their lowest levels in six months. Record supply from the U.S., Brazil, and Guyana, along with surging Iranian flows, are expected to lift world output by 1.8 million barrels a day to 101.9 million barrels a day in 2023.

Factuality Level: 8

Factuality Justification: The article provides information from the International Energy Agency’s monthly report, including projections for global oil-demand growth and economic growth. It also mentions the impact of higher interest rates, petrochemical activity in China, and record oil supply from various countries. The article does not contain any obvious bias or personal perspective, and the information provided is consistent and logical.

Noise Level: 7

Noise Justification: The article provides information on global oil-demand growth and the factors affecting it, such as higher interest rates and the macroeconomic climate. It includes data and estimates from the International Energy Agency and the Organization of the Petroleum Exporting Countries. However, the article lacks in-depth analysis and does not provide actionable insights or solutions.

Financial Relevance: Yes

Financial Markets Impacted: Oil markets and companies in the oil industry

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the expected weakening of global oil-demand growth due to the slowdown in major economies and higher interest rates. While there is no mention of an extreme event, the information provided is relevant to financial markets, specifically the oil markets and companies in the oil industry.

Public Companies: International Energy Agency (N/A), Organization of the Petroleum Exporting Countries (N/A)

Key People:

www.marketwatch.com

www.marketwatch.com