Precious Metals and Raw Materials on the Upswing

- Gold futures hit a record high

- Materials producers rise alongside precious metals

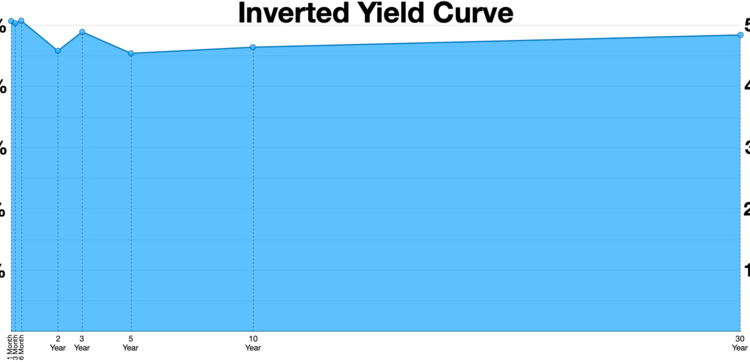

- Federal Reserve official suggests extended cycle of U.S. rate cuts

- U.S. dollar remains at multiyear lows against rivals

The price of gold futures reached a record high of $2626.50 an ounce as producers of metals and raw materials experienced growth, fueled by speculation about further U.S. rate cuts. This comes amid tensions in the Middle East and comments from Federal Reserve President Austan Goolsbee, who suggested that interest rates will need to continue dropping for a smooth economic recovery. The U.S. dollar has remained at multiyear lows against other currencies due to these factors. Meanwhile, the British pound sterling has seen gains following the Bank of England’s decision not to implement additional rate cuts.

Factuality Level: 8

Factuality Justification: The article provides relevant information about the rise in metal and raw material producers, gold futures, and Federal Reserve official’s comments on interest rates. It also mentions the British pound sterling’s performance after the Bank of England meeting. The information is presented without any clear signs of sensationalism or opinion masquerading as fact.

Noise Level: 3

Noise Justification: The article provides relevant information about the rise in metal and raw material prices, gold futures, and interest rates, but it lacks a detailed analysis or exploration of long-term trends or consequences. It also does not offer actionable insights or new knowledge for readers.

Key People: Austan Goolsbee (Chicago Federal Reserve President)

Financial Relevance: Yes

Financial Markets Impacted: Metals and precious metals markets, U.S. dollar and British pound sterling

Financial Rating Justification: The article discusses the impact of rate bets on metal prices, Federal Reserve’s comments about U.S. rate cuts, and the Bank of England’s decision regarding interest rates, which directly pertain to financial topics and affect various markets.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the text and it’s not the main topic. The text discusses economic events such as metal prices and interest rates.

Move Size: 0.25%

Sector: All

Direction: Up

Magnitude: Medium

Affected Instruments: Stocks, Commodities

www.marketwatch.com

www.marketwatch.com