Precious Metal Falls Towards $2,500 Amid Strengthening Dollar and Job Growth Data

- Gold prices decline towards $2,500 mark

- Futures prices for gold fall two days after hitting a record high

- Expected guidance on US interest-rate cut in September from Powell’s speech

- Dollar strength contributes to gold price drop

- Central banks driving the rally

- U.S. job growth weaker than initially estimated

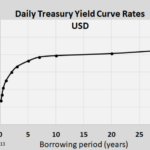

- FOMC minutes indicate officials open to immediate rate cuts

Gold prices have taken a hit on Thursday due to the strengthening US dollar and weaker job growth data. This comes just before Federal Reserve Chair Jerome Powell’s anticipated speech at the Jackson Hole Economic Symposium, where guidance on the size of an expected interest rate cut in September is expected. The precious metal had reached a record high of $2,550.60 earlier this week. Central banks have been driving the gold rally, but the dollar’s recovery may be limited due to expectations for a Federal Reserve rate cut. Minutes from the Federal Open Market Committee’s July meeting revealed several officials were open to immediate interest rate cuts.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about the decline in gold prices due to the strength of the U.S. dollar and expectations for a potential interest rate cut by the Federal Reserve. It also includes expert opinions from Jim Wyckoff and Rania Gule. The article is focused on the main topic and does not contain irrelevant or sensational information, repetitive details, or personal perspectives presented as facts.

Noise Level: 3

Noise Justification: The article provides relevant information about gold prices and their relation to the U.S. dollar and Federal Reserve’s interest rate decisions. However, it contains some repetitive information and could benefit from more in-depth analysis or context on the broader implications of these trends.

Public Companies: FactSet (FDS), ICE (ICE)

Key People: Jerome Powell (Federal Reserve Chair), Jim Wyckoff (Senior Analyst at Kitco.com), Rania Gule (Senior Market Analyst at XS.com)

Financial Relevance: Yes

Financial Markets Impacted: Gold and U.S. dollar markets

Financial Rating Justification: The article discusses the decline in gold prices due to the strength of the U.S. dollar, and the potential impact of Federal Reserve Chair Jerome Powell’s speech on interest rates and gold prices.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article.

Move Size: The market move size mentioned in this article is 1.1% for gold prices, as they declined $27.10 and settled at $2,520.40 an ounce after trading as low as $2,506.40.

Sector: All

Direction: Down

Magnitude: Large

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com