Gold Futures Edge Higher Amid Mixed Economic Data

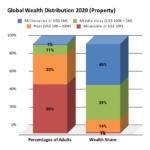

- Gold futures edged higher due to strength in the U.S. dollar following a stronger-than-expected September jobs report

- Gold prices initially declined but later rebounded impressively

- U.S. economy created 254,000 new jobs in September, beating expectations of 150,000

- Unemployment rate fell to 4.1% from 4.2%

- Gold futures settled at a record-high $2,694.90 and touched an all-time intraday high of $2,708.70 on Sept. 26

Gold futures experienced a rebound after initially declining due to a stronger-than-expected September jobs report. The U.S. economy added 254,000 new jobs, surpassing expectations of a 150,000 increase. The unemployment rate dropped from 4.2% to 4.1%. Despite the initial decline, gold prices later edged higher, with futures settling at a record-high $2,694.90 and touching an all-time intraday high of $2,708.70 on September 26th. Analysts believe this could be just another pause in the ongoing bull run for gold prices.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about gold futures, the U.S. jobs report, and its impact on gold prices. It includes quotes from an expert in the field to support its claims and offers a broader perspective on the market trends.

Noise Level: 3

Noise Justification: The article provides relevant information about gold futures and the impact of the jobs report on their prices. It also includes insights from an expert in the field. However, it lacks a deep analysis or exploration of long-term trends or possibilities, accountability, and actionable insights for readers.

Key People: Brien Lundin (editor of Gold Newsletter)

Financial Relevance: Yes

Financial Markets Impacted: Yes

Financial Rating Justification: The article discusses the impact of the September jobs report on gold futures and the U.S. dollar, as well as the Federal Reserve’s potential interest rate cuts. This pertains to financial topics such as gold prices, Treasury yields, and the U.S. economy. The job report and potential Fed actions can affect financial markets and companies involved in these sectors.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the text.

Move Size: 0.6%

Sector: All

Direction: Up

Magnitude: Small

Affected Instruments: Stocks, Bonds

www.marketwatch.com

www.marketwatch.com