David Einhorn’s hedge fund makes strategic changes in its portfolio

- Greenlight Capital adds new stake in Kenvue Inc.

- Also adds exposure to Teva Pharmaceutical Industries Ltd.

- Adds exposure to exchange-traded funds

- Maintains steady stake in SPDR Gold shares fund

- Exits Activision Blizzard Inc. and Southwestern Energy Co.

David Einhorn’s hedge fund, Greenlight Capital, made several notable moves in its portfolio during the fourth quarter. The fund added a new stake in Kenvue Inc., the former consumer healthcare division of Johnson & Johnson, and also increased its exposure to Teva Pharmaceutical Industries Ltd. Additionally, Greenlight added exposure to various exchange-traded funds while maintaining a steady stake in the SPDR Gold shares fund. On the other hand, the fund exited positions in Activision Blizzard Inc. and Southwestern Energy Co. These strategic changes reflect Greenlight’s ongoing efforts to optimize its investment portfolio.

Public Companies: Kenvue Inc. (KVUE), Johnson & Johnson (JNJ), Teva Pharmaceutical Industries Ltd. (TEVA), SPDR Gold shares fund (GLD), Activision Blizzard Inc. (N/A), Southwestern Energy Co. (SWN)

Private Companies:

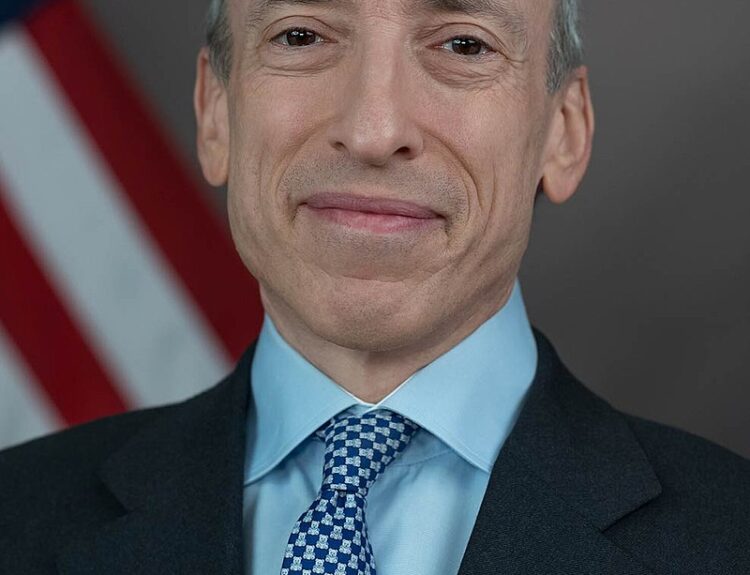

Key People: David Einhorn (Founder of Greenlight Capital)

Factuality Level: 7

Justification: The article provides information about David Einhorn’s hedge fund Greenlight Capital picking up a new stake in Kenvue Inc. and adding exposure to Teva Pharmaceutical Industries Ltd. The information is based on a public filing with the U.S. Securities and Exchange Commission. The article also mentions Greenlight’s exit from Activision Blizzard Inc. and Southwestern Energy Co. The information provided seems to be based on factual events and public filings, but it lacks additional context and analysis.

Noise Level: 3

Justification: The article provides information about David Einhorn’s hedge fund Greenlight Capital picking up a new stake in Kenvue Inc. and adding exposure to Teva Pharmaceutical Industries Ltd. It also mentions the hedge fund’s holdings in exchange-traded funds and the SPDR Gold shares fund. However, the article lacks analysis, evidence, and actionable insights. It is a short news piece that simply reports on the hedge fund’s activities without providing any meaningful analysis or context.

Financial Relevance: Yes

Financial Markets Impacted: The article provides information about David Einhorn’s hedge fund Greenlight Capital acquiring a stake in Kenvue Inc. and adding exposure to Teva Pharmaceutical Industries Ltd. This could potentially impact the financial markets and the companies involved.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article focuses on financial topics, specifically the activities of Greenlight Capital and its investments in Kenvue Inc. and Teva Pharmaceutical Industries Ltd. There is no mention of any extreme events.

www.marketwatch.com

www.marketwatch.com