Shelter inflation remains stubbornly high, and a housing market rebound could worsen the situation

- Shelter costs responsible for two thirds of CPI’s monthly price increase

- Shelter inflation remains high, posing a problem for consumers and the Federal Reserve

- A rebound in the housing market could worsen the situation

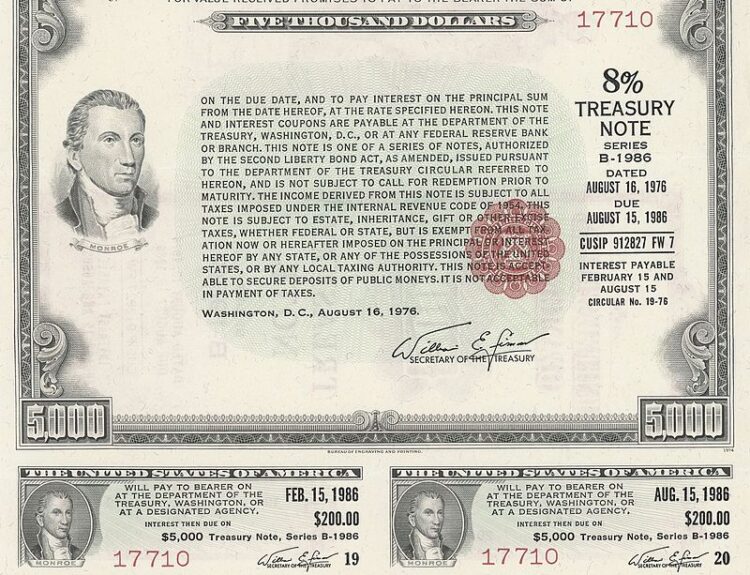

- Stocks dropped and Treasury yields rallied after stronger-than-expected inflation

- Rent costs continue to be challenged by lack of inventory

- Home prices rebounding, positive rent growth in cities, and increased home purchase loan applications signal a housing recovery

- Risk of renewed uptick in inflation from housing could complicate the Fed’s job

- 10-year Treasury yield increased, potentially leading to higher mortgage rates

- Investors in home builders experienced declines

Shelter costs continue to be a major contributor to the monthly price increase, with two thirds of the increase attributed to shelter inflation. This poses a problem for consumers and the Federal Reserve, as the housing market shows signs of a rebound. The recent stronger-than-expected inflation led to a drop in stocks and a rally in Treasury yields. Despite apartment rents no longer rising and single-family rent growth at low single-digits, shelter inflation remains high. The lag in CPI shelter measure data collection and the low inventory of homes on the market contribute to the persistence of high shelter costs. While home prices fell last year, they have rebounded, and there is an increase in demand and positive rent growth in cities. This could put upward pressure on shelter inflation and complicate the Fed’s job. Investors in home builders also experienced declines, and the increase in Treasury yields may lead to higher mortgage rates.

Public Companies: National Association of Realtors (), CoreLogic (), S&P CoreLogic (), Apollo Global Management (), Mortgage Bankers Association (), iShares U.S. Home Construction (), S&P 500 ()

Private Companies:

Key People: Lawrence Yun (National Association of Realtors Chief Economist), Selma Hepp (CoreLogic’s chief economist), Torsten Slok (Apollo Global Management’s chief economist), Jyoti Agarwal (), Rajvi Shah ()

Factuality Level: 7

Justification: The article provides information about the increase in shelter costs and its impact on inflation. It includes quotes from economists and data from the Bureau of Labor Statistics to support its claims. However, there is some speculation about future trends and potential implications for the Federal Reserve that is not backed by concrete evidence.

Noise Level: 4

Justification: The article provides relevant information about the impact of shelter inflation on consumers and the Federal Reserve. It discusses the reasons behind the stubbornness of shelter inflation and the potential implications of a rebound in the housing market. The article includes quotes from economists and data to support its claims. However, it lacks in-depth analysis and actionable insights.

Financial Relevance: Yes

Financial Markets Impacted: Stocks and 10-year Treasury yields

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the impact of shelter inflation on consumers and the Federal Reserve, as well as the potential implications for the housing market and mortgage rates. While there is no mention of an extreme event, the financial markets are directly affected by the inflation data and the potential increase in mortgage rates.

www.marketwatch.com

www.marketwatch.com