Improving results and unrealized gain contribute to profits

- IAC posts better-than-expected financial performance for Q4

- Improving results at Dotdash Meredith and large unrealized gain on MGM holdings contribute to profits

- CEO Joey Levin expresses optimism for the company’s future

- Revenue for the quarter is $1.058 billion, in line with estimates

- Dotdash Meredith’s digital revenues return to growth for the first time since acquisition

- Angi’s adjusted Ebitda for the quarter exceeds expectations

- IAC’s search business revenue falls below consensus

- Net income for the quarter is $327.8 million, thanks to unrealized gain on MGM stake

- IAC projects total adjusted Ebitda of $320 million to $420 million for 2024

Internet and media holding company IAC has reported a better-than-expected financial performance for the fourth quarter. The company’s profits were aided by improving results at Dotdash Meredith and a large unrealized gain on its holdings in MGM Resorts International. CEO Joey Levin expressed optimism for the company’s future, noting the healthy profit growth of its consolidated businesses. Revenue for the quarter was $1.058 billion, in line with estimates. Dotdash Meredith’s digital revenues returned to growth for the first time since the company’s acquisition of Meredith. Angi’s adjusted Ebitda for the quarter exceeded expectations, while IAC’s search business revenue fell below consensus. Net income for the quarter was $327.8 million, thanks to an unrealized gain on the company’s stake in MGM. Looking ahead, IAC projects total adjusted Ebitda of $320 million to $420 million for 2024.

Public Companies: IAC (IAC), MGM Resorts International (MGM), Dotdash Meredith (N/A), Angi (N/A), Care.com (N/A)

Private Companies:

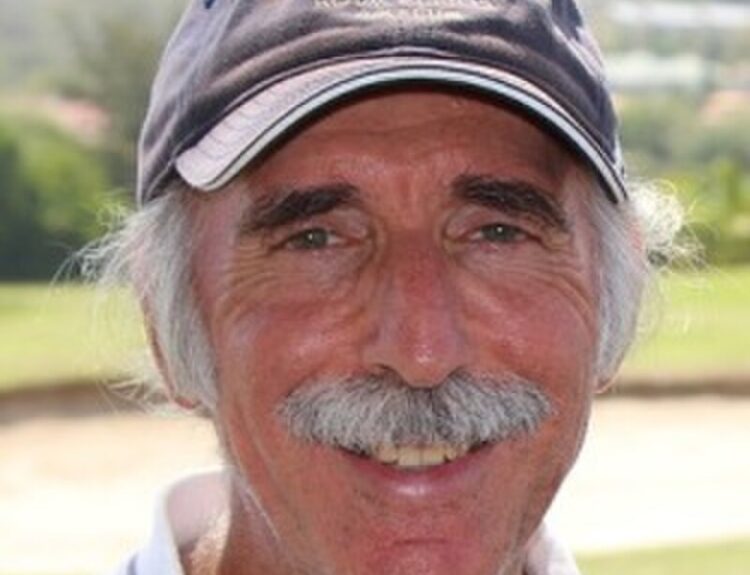

Key People: Joey Levin (CEO)

Factuality Level: 7

Justification: The article provides financial performance data for IAC in the fourth quarter, including revenue figures and earnings. The information is specific and quantifiable, which adds to its credibility. However, the article lacks context and analysis, and it does not provide any opposing viewpoints or potential risks. Therefore, while the information presented may be accurate, the article’s factuality level is reduced due to its limited scope and lack of comprehensive reporting.

Noise Level: 3

Justification: The article provides financial performance updates for IAC and its subsidiaries, including Dotdash Meredith and Angi. It includes revenue figures, earnings, and projections for the future. However, the article lacks in-depth analysis, scientific rigor, and actionable insights. It mainly focuses on financial numbers without exploring the consequences of decisions or holding powerful people accountable.

Financial Relevance: Yes

Financial Markets Impacted: IAC’s financial performance and results may impact investor sentiment and the stock market.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses IAC’s financial performance and projections for the future, indicating its relevance to financial topics. However, there is no mention of any extreme events or their impact.

www.marketwatch.com

www.marketwatch.com