Industrial Manufacturer IDEX Strengthens Position with Mott Acquisition

- IDEX acquires Mott Corp. and subsidiaries for $1 billion cash

- Transaction expected to be accretive to adjusted EPS in fiscal 2026

- Funding through cash, credit facility, and potential debt issuance

- Closing by Q3 end

- Mott generates about $200 million revenue in 2024

- Mott’s business aligns with IDEX’s focus on scalable select applications

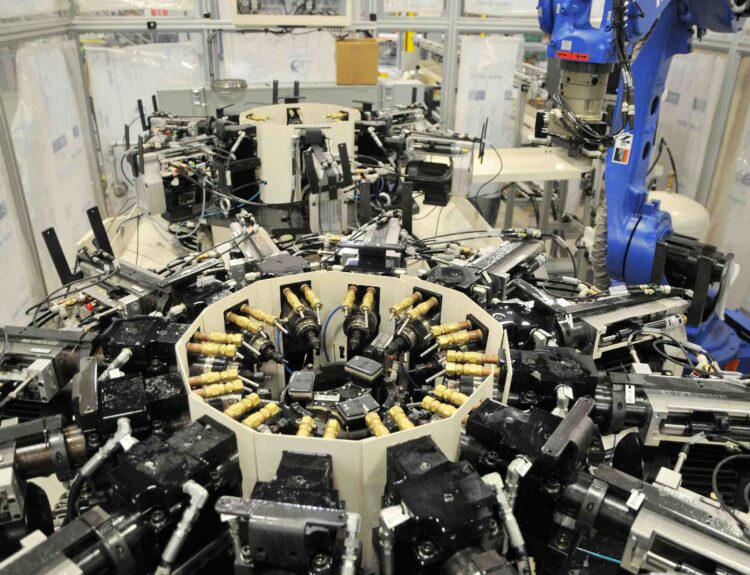

IDEX Corporation has agreed to acquire Mott Corporation and its subsidiaries in a cash deal valued at approximately $1 billion. The industrial manufacturer expects the acquisition to be accretive to adjusted earnings per share (EPS) by fiscal year 2026. Funding for the transaction will come from a combination of cash on hand, borrowing from its credit facility, and potential debt issuance. Mott, which specializes in sintered porous material structures and flow control solutions, is projected to generate around $200 million in revenue by 2024. Upon completion, Mott will join IDEX’s Health & Science Technologies segment, with over 500 employees from Mott joining the company. According to IDEX CEO Eric Ashleman, ‘Mott’s business fits the IDEX sweet spot of highly engineered, configurable mission-critical components focused on scalable select applications.’ The acquisition is expected to close by the end of Q3.

Factuality Level: 10

Factuality Justification: The article provides accurate and objective information about the acquisition of Mott Corp by IDEX, including details such as the cash consideration, expected impact on earnings, funding methods, revenue expectations, and the business fit with IDEX. It also includes a quote from the CEO explaining the rationale behind the acquisition.

Noise Level: 3

Noise Justification: The article provides relevant information about a company acquisition and its expected impact on the acquiring company’s financials, but it lacks in-depth analysis or exploration of long-term trends or consequences for those affected by the decision. It also does not delve into the specifics of Mott Corp.’s operations or the potential benefits to IDEX from the acquisition.

Public Companies: IDEX Corporation (IEX)

Private Companies: Mott Corp.

Key People: Eric Ashleman (Chief Executive)

Financial Relevance: Yes

Financial Markets Impacted: IDEX and Mott Corp.

Financial Rating Justification: The acquisition of Mott Corp. by IDEX for a significant amount of $1 billion will impact the financial markets as it involves a large transaction that affects the companies’ valuations, earnings, and operations.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no mention of an extreme event in the article.

www.marketwatch.com

www.marketwatch.com