Space Tech Provider Soars After Winning Massive Lunar Mission Deal

- Intuitive Machines’ stock soars after announcing a new contract with NASA

- Shares increased by about 35% in after-hours trading

- The latest contract could reach $4.8 billion over 10 years

- Intuitive will provide communication and navigation services for near space missions

- CEO Steve Altemus praises the partnership with NASA for Artemis campaign and lunar economy expansion

Intuitive Machines, a space technology provider, saw its stock soar after announcing a new contract with NASA worth up to $4.8 billion over ten years. The company will provide communication and navigation services for near-space missions. This deal marks a significant milestone in Intuitive’s leadership in space communications and navigation. CEO Steve Altemus expressed excitement about partnering with NASA to support the Artemis campaign and expand the lunar economy.

Factuality Level: 9

Factuality Justification: The article provides accurate and relevant information about the company’s stock performance, contract details, and CEO’s statement. It also includes context on the Odysseus lander mission and its significance.

Noise Level: 3

Noise Justification: The article provides relevant information about the company’s contract with NASA and its impact on stock prices, as well as a brief background on the company’s previous success. However, it contains some promotional language and focuses more on the stock performance than the actual implications of the contract for space technology or the industry.

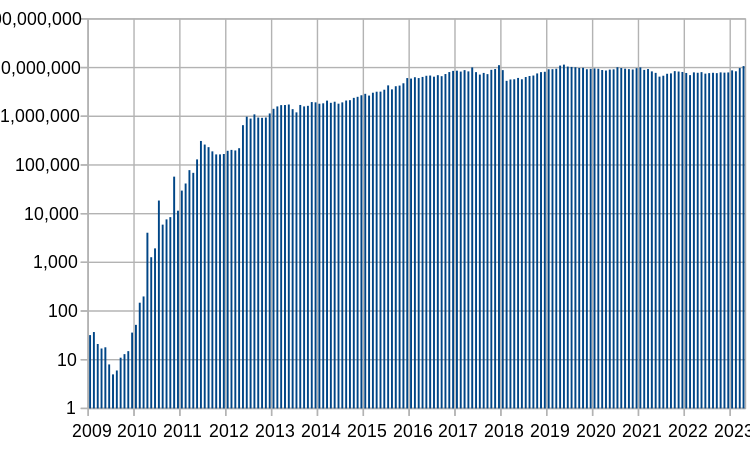

Public Companies: Intuitive Machines (INTU)

Key People: Steve Altemus (CEO)

Financial Relevance: Yes

Financial Markets Impacted: NASDAQ: Intuitive Machines’ stock price

Financial Rating Justification: The article discusses the increase in shares of space technology provider Intuitive Machines after announcing a new contract with NASA, impacting the company’s financial performance and potentially affecting its future sales. This information is relevant to investors and financial markets.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification:

Deal Size: 4800000000

Move Size: 35%

Sector: Technology

Direction: Up

Magnitude: Large

Affected Instruments: Stocks

www.barrons.com

www.barrons.com