The changing dynamics of the investment market and the need for individual investors to adapt

- Individual investors account for over two-thirds of investment assets in the U.S.

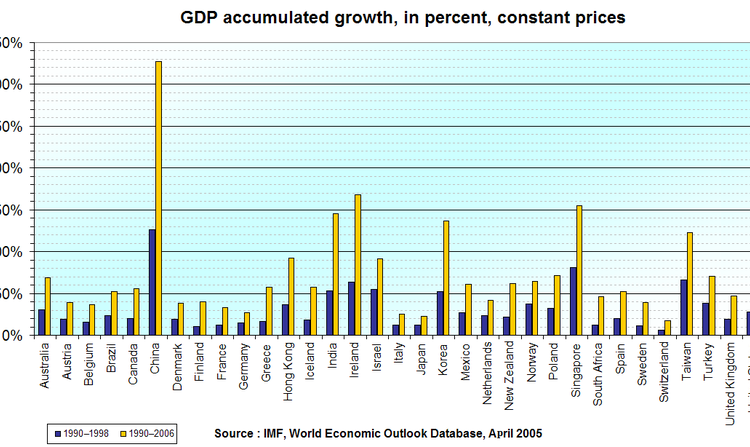

- The number of U.S.-listed public companies has more than halved in the past few decades.

- Private debt has increased almost fivefold since 2010.

- Individual investors need to invest like institutions, with a combination of public and private market investments.

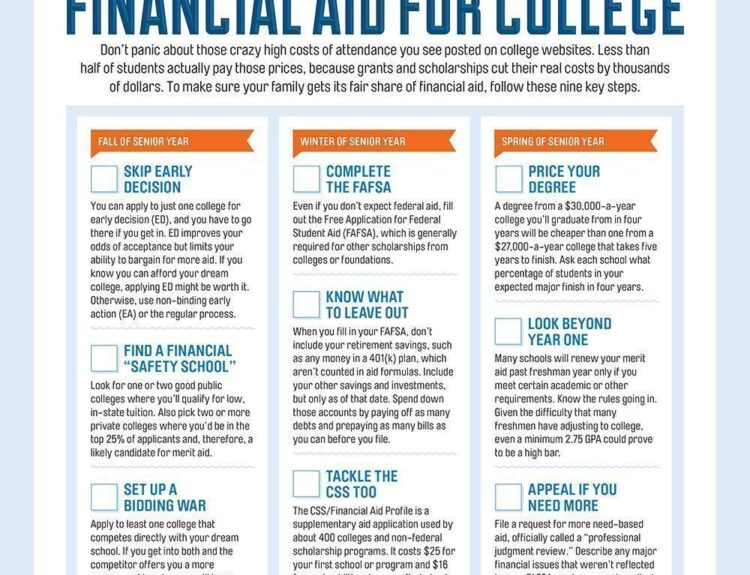

- Having an investment policy statement (IPS) can help protect against emotional decision-making.

- Missing just the 20 best days in the equity market over the past 30 years cuts returns in half.

- The asset and wealth management industry is transitioning to younger generations.

- Women could control up to an estimated $30 trillion in financial assets by 2030.

- We need to provide institutional practices and investments to individuals and make private investing simpler to understand and implement.

Over the past three decades, there have been two significant changes in the asset and wealth management industry that have had a profound impact on the U.S. economy and public markets. Firstly, there has been a generational shift in how Americans save for retirement, with most individuals now responsible for their own retirements. Secondly, there has been a reduction in the number of U.S.-listed public companies, while private equity firms have seen significant growth. Additionally, post-financial crisis reforms have led to a migration of lending from public bond markets to private markets. These changes mean that individual investors need to adopt an investment approach similar to institutions, with a combination of public and private market investments. Having an investment policy statement (IPS) can help protect against emotional decision-making, which often leads to missed opportunities in the market. Private investments, such as private equity and private credit, serve specific investment purposes and can help keep portfolios invested throughout market cycles. Looking ahead, the asset and wealth management industry is on the verge of another seismic change as wealth transitions from the silent generation and baby boomers to surviving partners and younger generations. Women, in particular, are set to control a significant amount of financial assets in the coming years. However, there is a need to close the confidence gap and make private investing simpler to understand and implement. In conclusion, the investment landscape has shifted from institutions to individuals, and it is crucial for individual investors to adapt their investment approach accordingly. By incorporating both public and private market investments, having an IPS, and addressing the needs of the changing investor demographic, successful outcomes can be achieved for a new generation of investors.

Factuality Level: 7

Factuality Justification: The article provides some factual information about the changes in the asset and wealth management industry and the shift from institutions to individuals. However, it also includes some subjective statements and opinions, such as the need for individuals to invest like institutions and the importance of tailoring investment approaches. Overall, the article contains a mix of factual information and personal perspective.

Noise Level: 3

Noise Justification: The article provides a clear analysis of the changes in the asset and wealth management industry and their impact on the U.S. economy. It highlights the shift from corporate defined-benefit plans to individual retirement savings and the reduction in public equity and bond markets. The article also discusses the need for individuals to invest like institutions and the importance of having an investment policy statement. It provides data and examples to support its claims. However, the article contains some irrelevant information about the author’s personal retirement plan and includes a promotional message at the end.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the changes in the asset and wealth management industry, which can have an impact on financial markets and companies in the sector.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article primarily focuses on the changes in the asset and wealth management industry and does not mention any extreme events.

Public Companies: BNY Mellon (N/A)

Private Companies: Airbnb,Birkenstock

Key People: Catherine Keating (Global Head of BNY Mellon Wealth Management)

www.marketwatch.com

www.marketwatch.com