Uranium Sector Sees Increased M&A Activity Amid Geopolitical Tensions

- IsoEnergy acquires Anfield Energy in a C$126.8M deal

- Increased uranium assets and production capacity in the US

- Shootaring Canyon Mill acquisition boosts IsoEnergy’s portfolio

- Uranium prices surge due to geopolitical events

- Analysts predict more M&A activity in the sector

IsoEnergy has agreed to acquire Anfield Energy in a C$126.8M deal, adding the Shootaring Canyon Mill and other uranium projects to its portfolio. The acquisition aims to increase IsoEnergy’s production capacity and tap into the growing demand for alternative reactor fuel sources. Uranium prices have surged following Russia’s invasion of Ukraine, leading analysts to predict more mergers and acquisitions in the sector. The deal will see IsoEnergy owning 84% of the enlarged company and Anfield shareholders holding the remaining 15%.

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about the acquisition of Anfield Energy by IsoEnergy, including details on the transaction value, assets acquired, and the reasons behind the deal (increased interest in nuclear energy. It also includes relevant background information on uranium prices and market trends.

Noise Level: 4

Noise Justification: The article provides relevant information about a business transaction between two companies in the uranium mining industry and discusses the current trends in nuclear energy demand. It offers some insights into the market dynamics but does not delve too deeply into the broader implications or long-term consequences of these events.

Public Companies: IsoEnergy (not provided), Anfield Energy (not provided), Paladin Energy (not provided), Fission Uranium (not provided), Denison Mines (not provided), Foremost Lithium Resource & Technology (not provided)

Key People: Philip Williams (Chief Executive)

Financial Relevance: Yes

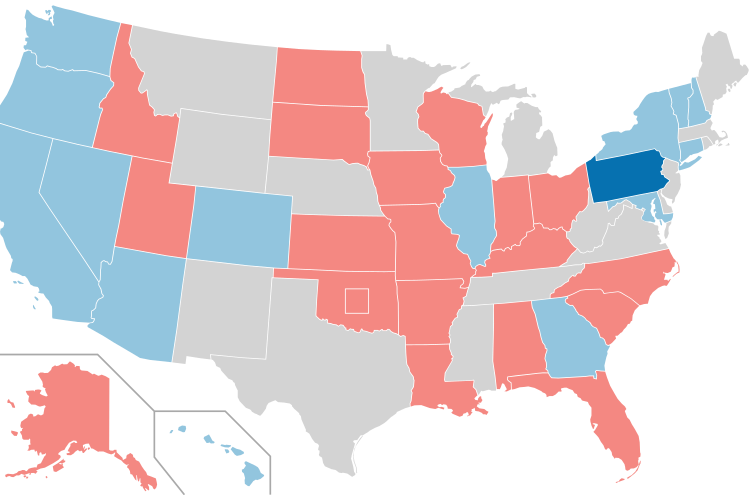

Financial Markets Impacted: Uranium market and mining companies

Financial Rating Justification: The article discusses a merger between IsoEnergy and Anfield Energy, two uranium mining companies. This deal will impact the uranium market as it increases IsoEnergy’s uranium assets in the U.S., and is influenced by the heightened interest in nuclear energy due to global events such as Russia’s invasion of Ukraine. The acquisition also affects other uranium mining companies like Paladin Energy and Denison Mines, which have made similar moves. This shows relevance to financial topics related to mergers and acquisitions in the mining industry and the uranium market.

Presence Of Extreme Event: No

Nature Of Extreme Event: Other

Impact Rating Of The Extreme Event: Minor

Extreme Rating Justification: There is no extreme event mentioned in the article, but the acquisition of Anfield Energy by IsoEnergy is a significant business transaction in the uranium industry due to increased interest in nuclear energy following Russia’s invasion of Ukraine.

Deal Size: The deal size is $94 million.

Move Size: No market move size mentioned.

Sector: Technology

Direction: Up

Magnitude: Medium

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com