Record-breaking departures and industry changes dominate the finance news this week

- Six advisor teams managing nearly $15 billion in assets left J.P. Morgan

- J.P. Morgan’s largest wave of departures

- Advisors moved ahead of an imminent deadline for transferring client assets

- Ritholtz Wealth Management experiencing organic growth

- Goldman Sachs sells its robo-advisor business to Betterment

- Challenges of working with wealthy children as clients

- Department of Labor issues fiduciary rule for retirement planning

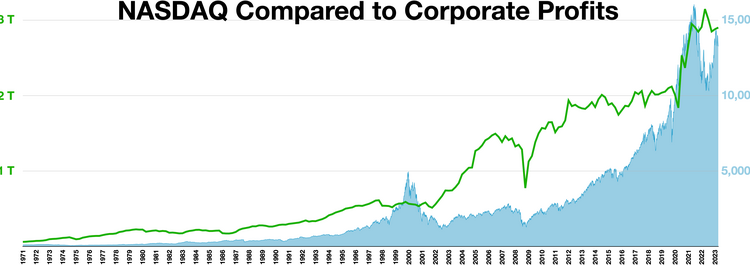

- Tech stocks and the challenge of investing in maturing technology companies

Six advisor teams managing nearly $15 billion in assets left JPMorgan Chase’s brokerage unit a week ago, the largest wave of departures one recruiter says he has seen. What explains J.P. Morgan ’s “bloody Friday,” as the recruiter termed it? Five of the six landed at J.P. Morgan when the Wall Street stalwart bought the failing First Republic Bank last year amid a regional banking crisis. One theory is that the advisors have been considering different options since then and pulled the trigger on a move just ahead of an imminent deadline for transferring client assets to J.P. Morgan’s platform. In other top wealth management articles this week: Ritholtz Wealth Management is experiencing organic growth, with plans for expansion around the country. Goldman Sachs is selling its robo-advisor business to Betterment as part of its efforts to pull back from the consumer-finance sector. Financial advisors face the challenge of working with wealthy children as clients, who often have complex feelings about money. The Department of Labor has issued a new fiduciary rule for financial professionals providing retirement planning advice, which has received mixed reactions from the industry. Lastly, investing in maturing technology companies poses unique challenges for investors, as they navigate the S-curve of growth. Keywords: J.P. Morgan, advisor teams, departures, Ritholtz Wealth Management, organic growth, Goldman Sachs, robo-advisor business, Betterment, wealthy children, complex feelings about money, Department of Labor, fiduciary rule, retirement planning, technology companies, S-curve

Factuality Level: 3

Factuality Justification: The article contains a lot of irrelevant information about different wealth management firms and their recent activities, which is not directly related to the main topic of advisor teams leaving JPMorgan Chase. There is also a lack of in-depth analysis or factual evidence to support the claims made in the article.

Noise Level: 3

Noise Justification: The article provides relevant information about recent departures at JPMorgan Chase’s brokerage unit and the reasons behind it. It also discusses significant changes in the wealth management industry, such as Goldman Sachs exiting the robo-advisor business and the challenges faced by financial advisors working with wealthy children. The article offers insights into the Department of Labor’s fiduciary rule and provides tips for evaluating technology companies as investments. Overall, the article stays on topic, supports its claims with examples, and offers actionable insights for readers.

Financial Relevance: Yes

Financial Markets Impacted: JPMorgan Chase’s brokerage unit

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article discusses the departure of advisor teams from JPMorgan Chase’s brokerage unit, which is relevant to financial markets. However, there is no mention of an extreme event or its impact.

Public Companies: J.P. Morgan Chase (JPM), Goldman Sachs (GS)

Private Companies: First Republic Bank,Ritholtz Wealth Management,Betterment,Creative Planning

Key People: Jay Tini (President of Ritholtz Wealth Management)

Reported publicly:

www.barrons.com

www.barrons.com