Nippon Life Insurance Seeks Higher Returns Amidst Rising Yields

- Japan’s largest insurer is increasing foreign credit investments

- Nippon Life Insurance diversifying its portfolio

- Investment in foreign floating-rate corporate debt securities and overseas corporate bonds

- Equivalent of $13 billion to $19 billion to invest this fiscal year

- Low yields from domestic bonds prompting the shift

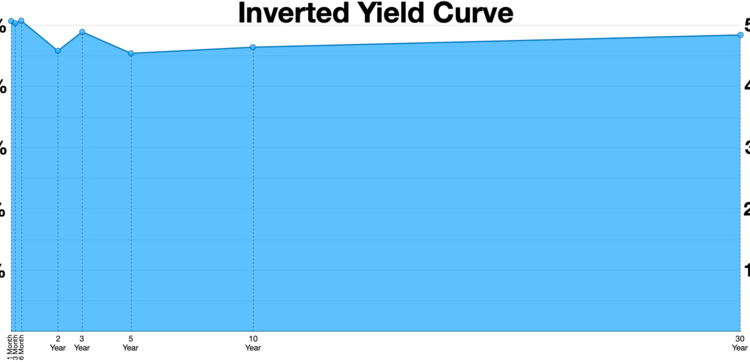

Despite higher domestic yields, Japan’s largest insurer Nippon Life Insurance is moving towards foreign credit markets to diversify its portfolio. The company has been investing in foreign floating-rate corporate debt securities and overseas corporate bonds this fiscal year. With more than $500 billion worth of assets, it bought billions of dollars of foreign corporate bonds last fiscal year. Nippon Life’s Ikumi Hiramatsu expects the Bank of Japan to raise its policy rate by 25 basis points between October and December but acknowledges uncertainty in predicting further increases. The insurer may also consider buying U.S. Treasurys if yields become attractive, despite potential dollar depreciation due to a possible Fed rate cut.°

Factuality Level: 8

Factuality Justification: The article provides accurate and objective information about Nippon Life Insurance’s investment strategy and its plans for diversifying its portfolio by investing more in foreign credit markets. It includes quotes from Ikumi Hiramatsu, who manages asset allocation at the company, and discusses the current state of Japanese government bond yields and potential future actions by the Bank of Japan and the Federal Reserve.°

Noise Level: 7

Noise Justification: The article provides relevant information about Nippon Life Insurance’s investment strategy and its plans for diversifying its portfolio by investing more in foreign credit markets. However, it contains some repetitive information and lacks a deep analysis of the long-term trends or possibilities in the financial market. It also does not offer much actionable insights or new knowledge that the reader can apply.°

Public Companies: Nippon Life Insurance Co. (Not available)

Key People: Ikumi Hiramatsu (Asset Allocation Manager at Nippon Life Insurance Co.)

Financial Relevance: Yes

Financial Markets Impacted: Japanese government bonds, foreign credit markets, U.S. Treasurys

Financial Rating Justification: The article discusses the investment strategies of Japan’s largest insurer, Nippon Life Insurance, and its plans to invest more in foreign credit markets and overseas corporate bonds while keeping an eye on domestic yields. It also mentions the potential impact on Japanese government bond yields and U.S. Treasurys.°

Presence Of Extreme Event: No

Nature Of Extreme Event: Other

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article. The focus is on Nippon Life Insurance’s investment strategy and their plans to invest more in foreign credit markets.°

www.wsj.com

www.wsj.com