Analysts see potential in utility-scale alternative energy companies

- Jefferies initiates buy ratings for First Solar, Enphase stocks

- Analysts see better risk/reward for companies with exposure to utility-scale

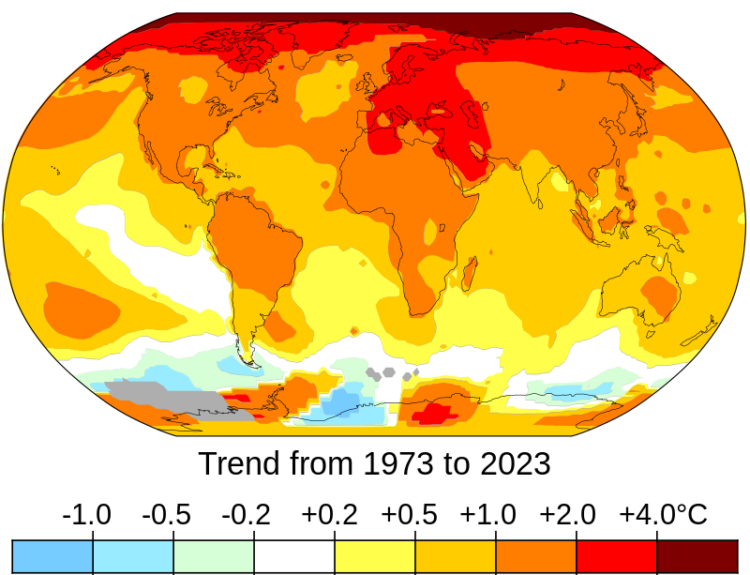

- Catalysts for the sector include clarity on Inflation Reduction Act provisions and stabilization of interest rates

- Alt-energy and solar-power stocks have underperformed due to higher interest rates and regulatory changes

- First Solar identified as top pick with strong backlog, supportive pricing, and strong balance sheet

Jefferies analysts have started their coverage of alternative-energy stocks, giving buy ratings to First Solar and Enphase Energy. They believe that companies with exposure to utility-scale, strong backlog, and strong balance sheets offer better risk/reward in times of uncertainty. The sector is expected to benefit from more clarity on Inflation Reduction Act provisions and the stabilization of interest rates. However, alt-energy and solar-power stocks have underperformed this year due to higher interest rates and regulatory changes. Among the buy-rated stocks, First Solar is identified as a top pick with a strong backlog, supportive pricing, and a strong balance sheet.

Factuality Level: 7

Factuality Justification: The article provides information about the alternative-energy stock coverage by analysts at Jefferies. It mentions the buy ratings given to First Solar Inc., Enphase Energy Inc., and SunRun Inc. It also discusses the hold ratings for SunPower Corp. and Array Technologies Inc. The article mentions catalysts for the sector and explains the underperformance of alt-energy and solar-power stocks. The information provided seems to be based on the analysis and opinions of the analysts, but it does not contain any misleading or inaccurate information.

Noise Level: 3

Noise Justification: The article provides information on the alternative-energy stock coverage by Jefferies and their buy ratings for certain stocks. It mentions the reasons for the ratings and the catalysts for the sector. However, it lacks in-depth analysis, evidence, and actionable insights. It mainly focuses on the ratings and basic information about the stocks.

Financial Relevance: Yes

Financial Markets Impacted: Alternative-energy stocks

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article pertains to financial topics as it discusses the coverage and ratings of alternative-energy stocks by analysts at Jefferies. However, there is no mention of any extreme event or its impact.

Public Companies: First Solar Inc. (FSLR), Enphase Energy Inc. (ENPH), SunRun Inc. (RUN), SunPower Corp. (SPWR), Array Technologies Inc. (ARRY)

Key People: Analysts at Jefferies (Analysts)

Reported publicly:

www.marketwatch.com

www.marketwatch.com