E-commerce Sales Provide a Glimmer of Hope for Joann

- JoAnn’s stock tumbles 12% after sales drop 4% and losses widen

- E-commerce sales show growth for Joann

- Joann reports a wider fiscal third-quarter loss

- Sales fell 4.1% to $539.8 million

- Same-store sales also dropped 4.1%, but e-commerce sales increased by 11.5%

- Joann expects sales for fiscal-year 2024 to be down 1% to 2%

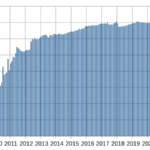

Shares of Joann Inc. fell over 12% after reporting a wider fiscal third-quarter loss and a 4% drop in sales, failing to meet expectations. The company lost $21.6 million in the quarter, compared to $17.5 million in the same quarter last year. Sales fell to $539.8 million, with same-store sales also dropping 4.1%. However, e-commerce sales saw a positive increase of 11.5%. Joann expects sales for fiscal-year 2024 to be down 1% to 2%. Overall, Joann’s stock has lost 69% this year.

Factuality Level: 7

Factuality Justification: The article provides specific information about Joann Inc.’s financial performance, including its wider fiscal third-quarter loss and sales that dropped 4%. It also mentions that the company failed to meet Wall Street’s expectations. The information is supported by specific figures and quotes from the company’s Chief Customer Officer. However, the article does not provide any analysis or context for the company’s performance, and it does not include any perspectives from other sources.

Noise Level: 3

Noise Justification: The article provides a brief overview of Joann Inc.’s financial performance in the fiscal third quarter. It mentions the company’s wider loss and lower sales compared to the previous year, but does not provide any in-depth analysis or insights. The article also includes a quote from the Chief Customer Officer, but it does not explore the consequences of the company’s performance on its stakeholders or hold anyone accountable. Overall, the article lacks scientific rigor, evidence, and actionable insights.

Financial Relevance: Yes

Financial Markets Impacted: Shares of Joann Inc.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Rating Justification: The article pertains to the financial performance of Joann Inc., a crafts retailer. It reports on the company’s wider fiscal third-quarter loss and lower sales, which resulted in a decrease in the company’s stock price. However, there is no mention of any extreme event or its impact.

Public Companies: Joann Inc. (JOAN)

Key People: Chris DiTullio (Chief Customer Officer and co-interim Chief Executive)

Reported publicly:

www.marketwatch.com

www.marketwatch.com