Investors advised to hold off on emerging markets until election uncertainty subsides.

- Emerging markets have seen a significant rally, with the iShares MSCI Emerging Markets ETF up 7.5% this month.

- JPMorgan advises caution, suggesting investors wait until after the U.S. elections before committing to emerging markets.

- The MSCI emerging index is currently undervalued compared to developed markets, but historical trends indicate potential volatility post-election.

- A Trump victory could lead to increased tariffs on Chinese imports, negatively impacting emerging markets.

- Emerging markets equities gained 8% after Biden’s 2020 election win, highlighting the importance of political outcomes.

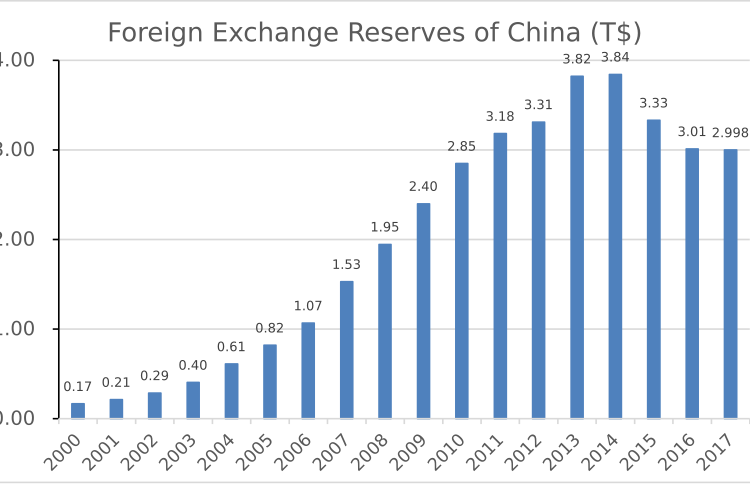

As September wraps up, Wall Street has experienced a positive month, with the S&P 500 rising by 1.6%. This optimism is largely fueled by China’s recent stimulus announcements and the Federal Reserve’s interest rate cut. Emerging markets have particularly benefited, with the iShares MSCI Emerging Markets ETF climbing 7.5% this month. However, JPMorgan’s equity strategists, led by Mislav Matejka, caution that it may be wise to hold off on long-term investments in emerging markets until after the U.S. elections. They note that while emerging-market equities are currently undervalued, historical data shows that political events can significantly impact market performance. For instance, after Trump’s 2016 victory, emerging markets fell by 10% relative to developed markets. The potential for a Trump win raises concerns about tariffs on Chinese imports and a stronger dollar, which could lead to further declines in emerging market assets. Conversely, emerging markets thrived following Biden’s election in 2020. Given the current overbought conditions in emerging markets, JPMorgan recommends a neutral stance until the election uncertainty clears, suggesting that opportunities may arise post-November.·

Factuality Level: 7

Factuality Justification: The article provides a detailed analysis of market trends and includes data from reputable sources like JPMorgan. However, it contains some speculative elements regarding future market performance and potential risks associated with the U.S. election, which may not be universally accepted as fact. Additionally, while the article is mostly factual, it could benefit from a more balanced presentation of viewpoints.·

Noise Level: 6

Noise Justification: The article provides a mix of relevant market analysis and specific data points, but it lacks deeper insights into the long-term implications of the trends discussed. While it references JPMorgan’s analysis and includes some actionable insights, it primarily focuses on short-term market movements and does not critically engage with broader economic narratives or hold powerful entities accountable.·

Public Companies: JPMorgan (JPM), iShares MSCI Emerging Markets ETF (EEM), Chrysler and Jeep (Stellantis) (STLA), AT&T (T), Aston Martin Lagonda (AML), Nvidia (NVDA), Tesla (TSLA), NIO (NIO), GameStop (GME), Alibaba (BABA), Taiwan Semiconductor Manufacturing (TSM), Apple (AAPL)

Private Companies: DirecTV Entertainment Holdings LLC,TPG

Key People: Mislav Matejka (Equity Strategist at JPMorgan), Michelle Bowman (Federal Reserve Governor), Jerome Powell (Fed Chair), Shigeru Ishiba (New Prime Minister of Japan)

Financial Relevance: Yes

Financial Markets Impacted: Emerging markets, S&P 500, Nasdaq Composite, 10-year Treasury, oil prices, gold prices, Nikkei 225, CSI 300

Financial Rating Justification: The article discusses the performance of various financial indices and markets such as emerging markets, S&P 500, Nasdaq Composite, 10-year Treasury, oil prices, gold prices, Nikkei 225, and CSI 300. It also mentions stock updates for companies like Nvidia, Tesla, NIO, GameStop, Alibaba, and AT&T’s sale of its controlling stake in DirecTV Entertainment Holdings LLC to TPG for about $7.6 billion in cash payments.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: The article discusses market trends and economic forecasts but does not report on any extreme event that occurred in the last 48 hours.·

Move Size: No market move size mentioned.

Sector: All

Direction: Up

Magnitude: Medium

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com