Bettors shift their stances as Harris’s polling improves and fundraising excels

- Betting markets now favor Kamala Harris over Donald Trump in the upcoming US presidential race

- Harris’s chances have increased to 53% while Trump’s dropped to 45%, according to RealClearPolitics average of six betting markets

- Bettors had previously viewed Trump as the favorite, but Harris’s performance in polls and strong fundraising shifted the odds

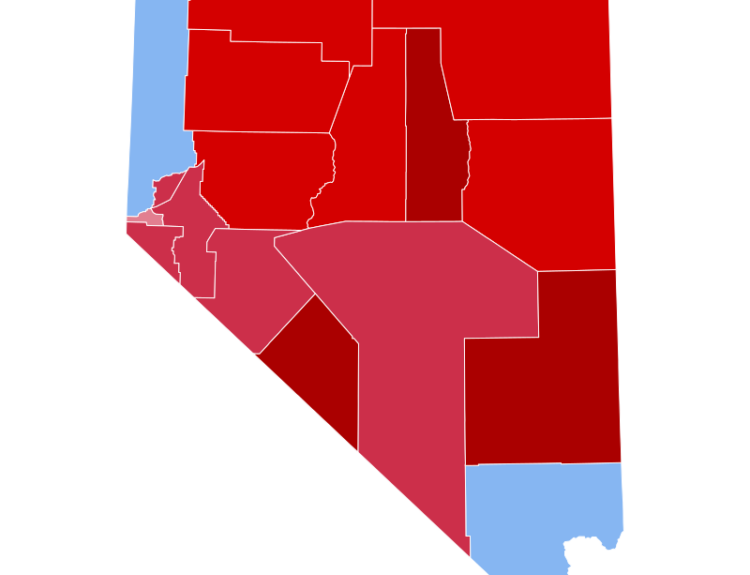

- Harris has an edge over Trump in Michigan and Wisconsin, while still trailing behind in Arizona, Georgia, and Pennsylvania

Donald Trump’s chances of winning the US presidential election have decreased, with betting markets now giving Kamala Harris a higher probability of victory. The former president had been viewed as the favorite until recently, but Harris’s improved performance in polls and strong fundraising have changed bettors’ opinions. Harris has an edge over Trump in Michigan and Wisconsin, while trailing behind in Arizona, Georgia, and Pennsylvania. Analysts believe the race is shifting towards Democrats.

Factuality Level: 7

Factuality Justification: The article provides accurate and objective information about the current state of betting markets and polls regarding the White House race between Donald Trump and Kamala Harris. It also includes relevant details about their economic pitches in North Carolina and the opinion of Raymond James analysts. However, it contains some minor digressions with off-topic examples like ‘no taxes on tips’ and ‘crypto voters’, which slightly detract from its focus.

Noise Level: 6

Noise Justification: The article provides some relevant information about betting markets and polls, but also includes speculative statements and unrelated references to Kamala Harris’s tax policy and the potential impact of crypto voters on the election outcome.

Key People: Kamala Harris (Democratic nominee), Donald Trump (Republican presidential nominee), Joe Biden (former President), Ed Mills (analyst at Raymond James)

Financial Relevance: Yes

Financial Markets Impacted: The article discusses betting markets’ predictions for the US presidential race, which can impact financial markets and companies due to potential policy changes or economic outcomes based on the winner.

Financial Rating Justification: The article mentions betting markets and their predictions for the US presidential election, which can influence investor sentiment and market movements depending on who is expected to win. This can affect various industries and sectors.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the article.

Move Size: No market move size mentioned.

Sector: All

Direction: Up

Magnitude: Large

Affected Instruments: Stocks

www.marketwatch.com

www.marketwatch.com