As Harris gears up for her presidential campaign, her tax strategies could reshape the financial landscape.

- Kamala Harris’s tax policies are expected to align closely with President Biden’s.

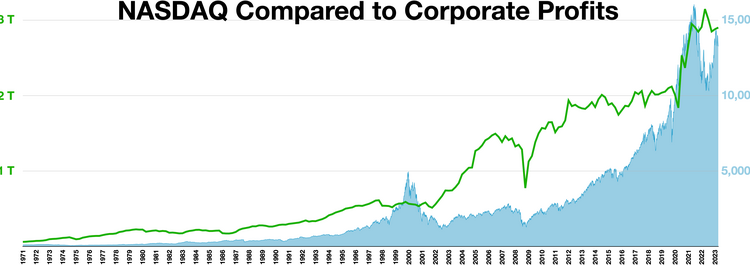

- Harris previously proposed higher taxes on wealthy individuals and corporations.

- Key questions remain about her stance on the $400,000 income threshold for tax increases.

- Harris has suggested raising the corporate tax rate back to 35%, higher than Biden’s proposed 28%.

- Her past proposals included taxing stock and bond trades to fund healthcare initiatives.

As Vice President Kamala Harris embarks on her presidential campaign, voters are eager to understand her tax policies. Experts suggest that her views are likely to mirror those of President Joe Biden, advocating for higher taxes on the wealthy and corporations. This stance contrasts sharply with former President Donald Trump’s approach, which favors extending and potentially reducing taxes from his 2017 tax law. nnBefore her vice presidency, Harris was a senator and a 2020 presidential candidate who aimed to repeal Trump’s Tax Cuts and Jobs Act, which benefits high earners and corporations. Her previous proposals included a significant tax credit for low- and middle-income families and a tax on stock, bond, and derivative trades to support healthcare coverage. nnHowever, questions remain about how she will approach tax policy moving forward. For instance, will she uphold Biden’s commitment not to raise taxes on individuals earning less than $400,000? This threshold has become a key talking point, but Harris has not made a firm pledge regarding it. nnAnother critical issue is the corporate tax rate. The Tax Cuts and Jobs Act reduced the corporate tax rate from 35% to 21%. Harris has previously expressed a desire to revert it back to 35%, which would be a more significant increase than Biden’s proposed 28%. nnAdditionally, Harris’s earlier proposal to tax stock trades at a rate of 0.2% and bond trades at 0.1% raises questions about whether she will revive such ideas in her campaign. While some analysts believe she may not run on a financial-transaction tax, they suggest she could still support it. nnHarris has also advocated for a new tax credit for low- and middle-income families, which could align with current Democratic priorities. As her campaign progresses, it will be crucial to see how her tax policies evolve and whether they will reflect her past proposals or align more closely with Biden’s administration. nnUltimately, the direction of Harris’s tax policies will be pivotal for voters looking to understand the financial implications of a potential Harris presidency.·

Factuality Level: 7

Factuality Justification: The article provides a detailed overview of Kamala Harris’s tax policy positions and how they compare to those of President Biden and former President Trump. While it presents various expert opinions and historical context, it occasionally veers into speculation about future policies without definitive statements from Harris’s campaign. Overall, it maintains a factual basis but includes some conjecture that could mislead readers about her current stance.·

Noise Level: 7

Noise Justification: The article provides a detailed analysis of Kamala Harris’s tax policy positions and how they compare to Biden and Trump, offering insights into potential future tax implications. It includes expert opinions and historical context, which adds depth. However, it could benefit from more direct accountability measures and clearer actionable insights for readers.·

Public Companies: Deloitte (DTE), KPMG (KPMG), Tax Foundation (N/A)

Private Companies: Prism Group

Key People: Kamala Harris (Vice President), Joe Biden (President), Donald Trump (Former President), Jon Traub (Managing Principal and Tax Policy Group Leader at Deloitte), John Stanford (Managing Partner at Prism Group), Erica York (Senior Economist at the Tax Foundation), Michael Linden (Former Executive Associate Director at the White House Office of Management and Budget), John Gimigliano (Principal in Charge of Federal Legislative and Regulatory Services at KPMG)

Financial Relevance: Yes

Financial Markets Impacted: The article discusses tax policies that could affect corporations and wealthy individuals, which in turn can influence financial markets.

Financial Rating Justification: The article focuses on Vice President Kamala Harris’s tax proposals and their implications for the economy, particularly how they may impact wealthy individuals and corporations, which are key factors in financial markets.·

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: The article discusses political strategies and tax policies related to Vice President Kamala Harris’s presidential campaign, but it does not mention any extreme events.·

www.marketwatch.com

www.marketwatch.com