Monitoring economic signals for potential rate adjustments

- Inflation cooling down and Fed hinting at rate cuts

- Investors expecting more rate cuts than projected

- Important indicators to watch for rate cuts: wage growth & service inflation, shelter costs & housing supply, consumer sentiment & inflation expectation, bond yields & spread

- Improving outlook on inflation and consumer sentiment

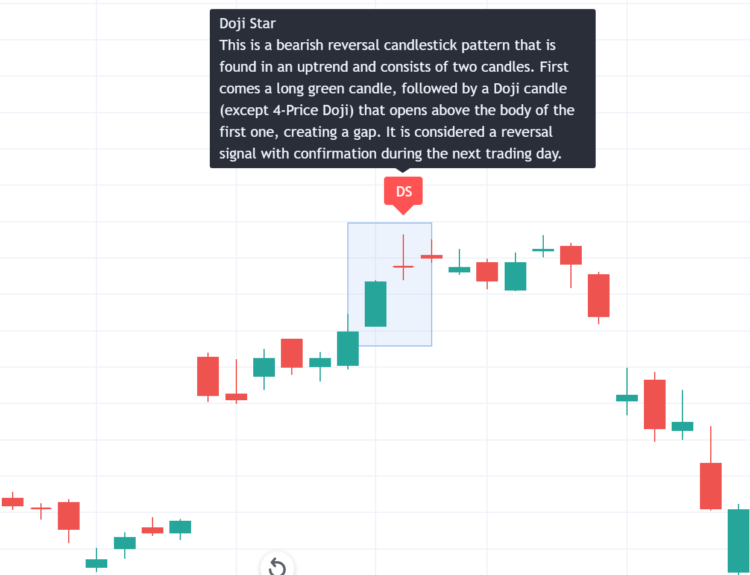

The Federal Reserve has hinted at potential rate cuts as inflation cools down. Investors are expecting more rate cuts than projected, with the futures markets anticipating a significant decrease in interest rates. However, Wall Street believes that rate cuts may be limited unless there is solid evidence of economic deterioration. Several indicators are crucial to monitor for potential rate cuts, including wage growth and service inflation, shelter costs and housing supply, consumer sentiment and inflation expectation, and bond yields and spread. These indicators provide insights into the state of the economy and can influence the Fed’s decision on rate adjustments. There are positive signs in some of these indicators, such as stabilizing labor costs and improving consumer sentiment. However, the bond market and yield curve inversion still raise concerns about the economy’s future. Monitoring these indicators will be essential in determining the likelihood and extent of future rate cuts by the Fed.

Public Companies: U.S. Federal Reserve Board (N/A)

Private Companies:

Key People: Jerome Powell (Federal Reserve Board Chairman)

Factuality Level: 7

Justification: The article provides information about the factors that could influence the Federal Reserve’s decision on interest rate cuts. It includes data and indicators such as wage growth, service inflation, housing supply, consumer sentiment, bond yields, and spread. The information provided is based on various sources and data, making it relatively factual. However, there is a possibility of bias or personal perspective in the article, as it includes statements from Wall Street and investors’ expectations. Overall, the article provides a balanced view of the factors that could impact the Federal Reserve’s decision on interest rates.

Noise Level: 6

Justification: The article provides some analysis of indicators that are important to watch in order to gauge whether the economy is ready for rate cuts. However, it lacks scientific rigor and intellectual honesty as it does not provide evidence or data to support its claims. Additionally, the article goes off-topic by discussing the bond market and junk bonds, which are not directly related to the main topic of rate cuts.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the potential impact of interest rate cuts by the Federal Reserve on the stock market and bond yields.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article focuses on the potential impact of interest rate cuts by the Federal Reserve on the economy and financial markets. It does not mention any extreme events.

www.marketwatch.com

www.marketwatch.com