New study reveals significant weight loss with Lilly’s Mounjaro compared to Novo’s Ozempic

- Lilly’s Mounjaro outperforms Novo’s Ozempic in real-world study

- Study shows patients on Mounjaro experienced more significant weight loss

- Average weight loss after 12 months: 15.2% for Mounjaro, 7.9% for Ozempic

- 42.3% of Mounjaro patients achieved at least 15% weight loss within a year

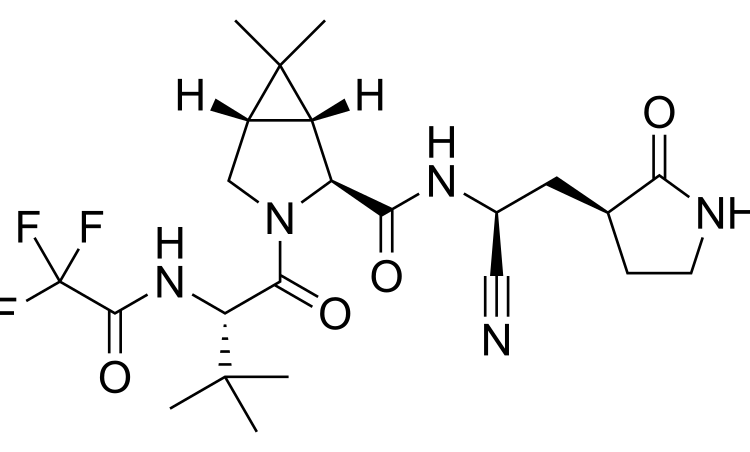

- Mounjaro targets both GLP-1 and GIP receptors, potentially explaining its superior efficacy

- Data from Lilly’s head-to-head trial with Novo’s drug will not be available until 2025

A recent real-world study comparing Eli Lilly’s Mounjaro and Novo Nordisk’s Ozempic has shown that Mounjaro is a more effective weight loss treatment. The study, conducted by health data company Truveta, analyzed electronic health records of over 40,000 overweight or obese patients. The results indicate that patients taking Mounjaro experienced more significant weight loss after three, six, and 12 months compared to those taking Ozempic. On average, patients on Mounjaro lost 15.2% of their body weight after 12 months, while patients on Ozempic lost 7.9%. Additionally, 42.3% of Mounjaro patients achieved at least 15% weight loss within a year. The study suggests that Mounjaro’s dual action, targeting both GLP-1 and GIP receptors, may explain its superior efficacy. However, data from Lilly’s ongoing head-to-head trial with Novo’s drug will not be available until 2025.

Public Companies: Eli Lilly (LLY), Novo Nordisk (NVO)

Private Companies:

Key People:

Factuality Level: 7

Justification: The article provides information from a new study conducted by Truveta, a health data company, which suggests that Eli Lilly’s obesity shot is more effective for weight loss than Novo Nordisk’s. The study includes data from over 40,000 overweight or obese patients and indicates that patients taking the Lilly drug experienced more significant weight loss than those taking the Novo drug. However, the study has not yet been peer-reviewed, and a head-to-head trial comparing the two drugs is still ongoing. The article acknowledges that the results are not surprising and align with previous trials. It also mentions that Lilly is running its own trial, and data from that trial will not be available until 2025. The article provides some context about the market for weight loss drugs and mentions that both companies are still finding their place in the evolving market. Overall, the article presents the study findings but acknowledges the limitations and ongoing research.

Noise Level: 7

Justification: The article provides information on a new study comparing the effectiveness of Eli Lilly’s obesity shot and Novo Nordisk’s weight loss treatment. It mentions that the study has not yet been peer-reviewed and that a head-to-head trial is still ongoing. The article includes data from the study, which suggests that patients taking the Lilly drug experienced more significant weight loss than those taking the Novo drug. It also discusses the potential reasons for the difference in efficacy between the two drugs. However, the article lacks scientific rigor as it does not provide details on the methodology of the study or the specific data points. It also does not explore the potential risks or side effects of the drugs. Overall, the article provides some useful information but lacks depth and scientific rigor.

Financial Relevance: Yes

Financial Markets Impacted: The article discusses the effectiveness of weight loss treatments developed by Eli Lilly (LLY) and Novo Nordisk (NVO). It provides insights into the potential market impact of these drugs and the evolving market for weight loss treatments.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article focuses on the comparison of weight loss treatments and their potential impact on the companies involved. It does not mention any extreme events or their impact.

www.marketwatch.com

www.marketwatch.com