Navigating the storm: Why investors should stay calm despite rising oil risks.

- Concerns over Israel potentially attacking Iran’s oil facilities are rising.

- President Biden’s comments led to a significant spike in crude oil prices.

- Iran’s oil production accounts for 3-4% of global supply, limiting potential price shocks.

- Saudi Arabia and OPEC are likely to increase production to stabilize prices.

- The U.S. dockworkers’ strike has ended, alleviating supply chain fears.

- Spirit Airlines is facing potential bankruptcy as it reduces capacity.

- Retailers are preparing for a shorter holiday shopping season with mixed sales predictions.

- A federal judge blocked Biden’s student loan forgiveness plan, prolonging the legal battle.

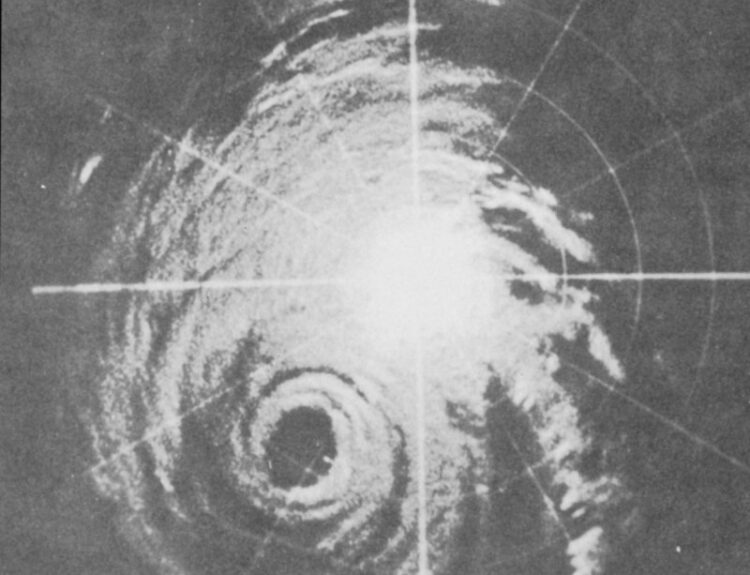

As one market concern begins to ease, another is emerging, particularly regarding the potential for Israel to strike Iran’s oil facilities. President Joe Biden’s recent remarks about Israel’s intentions have caused crude oil prices to surge, marking the largest one-day increase since October of last year. However, investors are advised not to panic. While Israel’s actions could impact oil supply, Iran only contributes about 3-4% of global oil production, meaning even a significant strike may not push prices above $100 a barrel. Additionally, OPEC, including Saudi Arabia, is expected to ramp up production to mitigate any shocks. Global oil demand remains sluggish, and while tensions in the Middle East are escalating, a broader conflict seems unlikely. This situation creates a challenging environment for investors, especially with the U.S. jobs report adding to market volatility. In other news, the recent end of the U.S. dockworkers’ strike has relieved concerns over supply chain disruptions, allowing businesses to resume normal operations. Meanwhile, Spirit Airlines is in talks with bondholders regarding a potential bankruptcy, as the airline plans to cut its capacity significantly. Retailers are bracing for a shorter holiday shopping season, with predictions for sales growth varying widely. Lastly, a federal judge has blocked the Biden administration’s student loan forgiveness plan, prolonging the ongoing legal disputes surrounding it. Overall, while there are several economic challenges ahead, the situation remains manageable for investors.·

Factuality Level: 6

Factuality Justification: The article provides a mix of relevant information regarding market reactions to geopolitical events and economic indicators. However, it includes some tangential details and opinions that detract from its overall clarity and objectivity. While it does not contain outright misinformation, the presentation of certain perspectives may lead to bias, and the structure could be more focused.·

Noise Level: 6

Noise Justification: The article provides a mix of relevant information regarding market reactions to geopolitical events and economic indicators. However, it lacks a deeper analysis of long-term trends and does not hold powerful entities accountable. While it presents some data and examples, it does not offer actionable insights or solutions, which limits its overall effectiveness.·

Public Companies: CVS Health (CVS), Spirit Airlines (SAVE), OpenAI (), Deutsche Bank (DB)

Key People: Joe Biden (President), Adam Clark (Author), Paul R. La Monica (Author), Janet H. Cho (Author), Evie Liu (Author), George Glover (Author), Elsa Ohlen (Author), Anita Hamilton (Author), Liz Moyer (Newsletter Editor), Patrick O’Donnell (Newsletter Editor), Rupert Steiner (Newsletter Editor)

Financial Relevance: Yes

Financial Markets Impacted: Yes

Financial Rating Justification: The article discusses various financial topics including the impact of geopolitical tensions on oil prices, the implications of a dockworkers’ strike on supply chains, and the potential bankruptcy of Spirit Airlines. The mention of rising oil prices due to Israel’s potential actions against Iran directly relates to financial markets, as it could influence crude oil prices and subsequently affect retail gasoline prices. Additionally, the dockworkers’ strike and its resolution have implications for businesses reliant on imports, which can impact market stability.·

Presence Of Extreme Event: Yes

Nature Of Extreme Event: Armed Conflicts and Wars

Impact Rating Of The Extreme Event: Moderate

Extreme Rating Justification: The article discusses the potential for Israel to strike Iranian oil facilities, which could escalate tensions in the Middle East. While this situation poses risks, it is not currently resulting in direct casualties or widespread destruction, hence the moderate impact rating.·

Move Size: No market move size mentioned.

Sector: All

Direction: Up

Magnitude: Medium

Affected Instruments: Commodities

www.barrons.com

www.barrons.com