Chinese medical device manufacturer sets price range for IPO

- Med Eiby Holdings to sell 4 million shares in IPO

- Shares priced between $4 to $6 each

- Expected net proceeds of about $17.13 million

- Funds to be used for expansion, acquisitions, R&D, and more

- Company had $3.32 million in revenue and a loss of $704,873 in FY2020

- Applying to list shares on Nasdaq Capital Market under ticker BSME

- Underwriter for the offering is Boustead Securities

Med Eiby Holdings, a Chinese medical device manufacturer, plans to sell 4 million shares in its initial public offering (IPO) at a price range of $4 to $6 per share. The company expects to generate net proceeds of approximately $17.13 million from the offering, which will be used for expanding into new markets, acquiring or investing in new businesses, research and development, sales and distribution, and general corporate purposes. In the fiscal year ended June 30, Med Eiby had $3.32 million in revenue but incurred a loss of $704,873. The company is seeking to list its shares on the Nasdaq Capital Market under the ticker BSME, with Boustead Securities serving as the underwriter for the offering.

Public Companies: Med Eiby Holdings (BSME)

Private Companies:

Key People: Ben Glickman (Author)

Factuality Level: 8

Justification: The article provides specific information about Med Eiby Holdings’ plans to sell shares in its initial public offering, including the number of shares, the expected price range, and the intended use of the proceeds. It also mentions the company’s financial performance in the previous fiscal year. The information provided seems factual and does not contain any obvious bias or misleading statements.

Noise Level: 3

Justification: The article provides information about Med Eiby Holdings’ initial public offering, including the number of shares being sold, the expected price range, and the intended use of the proceeds. However, it lacks analysis, evidence, or insights into the long-term trends or consequences of the offering. It also does not provide any information on the company’s products, competitive landscape, or potential risks. Overall, the article is short and lacks depth.

Financial Relevance: Yes

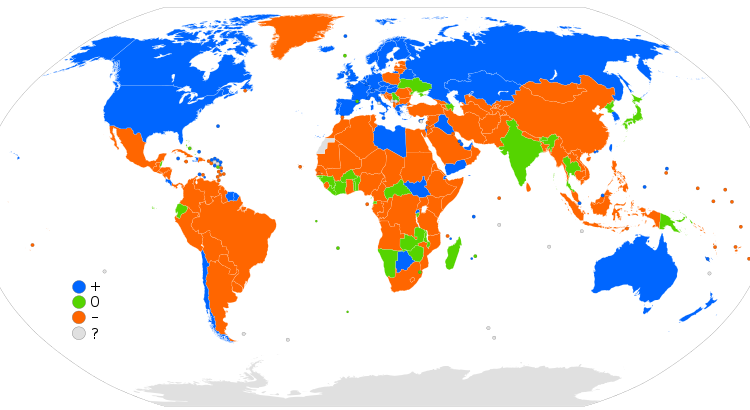

Financial Markets Impacted: Nasdaq Capital Market

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article pertains to financial topics as it discusses Med Eiby Holdings’ initial public offering and the sale of shares. There is no mention of an extreme event.

www.marketwatch.com

www.marketwatch.com