Investment bank expects non-OPEC supply growth to outpace demand

- Morgan Stanley predicts lower global crude oil prices this year and next

- Brent crude prices may average $80/bbl in Q1, but likely to weaken to $77/bbl by mid-year

- Non-OPEC supply growth expected to outpace rising global demand

- OPEC+ could extend or deepen production cuts this year

- Call on OPEC oil likely to fall by 600,000 b/d as non-OPEC countries gain market share

- Global oil stocks expected to rise by 500,000 b/d this year

- Long-term underlying trend for oil growth is 1.3 million b/d to 1.4 million b/d

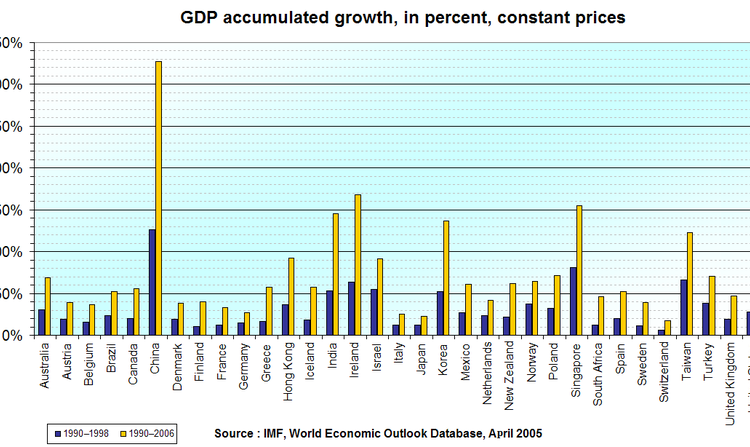

- Global population growth and GDP growth contribute to oil demand

- Electricity substitution and growth in petrochemical corridor considered

- Jet fuel demand projected to rise by 500,000 b/d early this year

Morgan Stanley has released a report predicting lower global crude oil prices for this year and next. The investment bank forecasts that Brent crude prices may average around $80 per barrel in the first quarter, but are likely to weaken to $77 per barrel by mid-year. The key factor behind this forecast is the expectation that non-OPEC supply growth will outpace rising global demand. The report also suggests that OPEC+ could extend or deepen production cuts this year, similar to what was done in 2023. Additionally, the call on OPEC oil is expected to decrease by about 600,000 barrels per day as non-OPEC countries gain a larger market share. The report highlights that global oil stocks are projected to rise by 500,000 barrels per day this year, indicating a modest oversupply. While the long-term underlying trend for oil growth is estimated to be around 1.3 million to 1.4 million barrels per day, the report acknowledges the potential impact of factors such as electricity substitution and growth in the petrochemical corridor. Furthermore, Morgan Stanley predicts that jet fuel demand will rise by approximately 500,000 barrels per day early this year. Overall, the report suggests a broad weakening of the oil complex and lower oil prices in the coming years.

Public Companies: Morgan Stanley (MS)

Private Companies:

Key People: Tom Kloza (Reporter), Jeff Barber (Editor)

Factuality Level: 7

Justification: The article provides a detailed analysis of Morgan Stanley’s report on global crude oil prices, including their forecast and the factors influencing it. The information is based on the bank’s analysis and projections, which adds credibility to the article. However, it is important to note that the article does not provide any counterarguments or alternative perspectives, which could limit the overall factuality level.

Noise Level: 7

Justification: The article provides some analysis and forecasts on global crude oil prices, but it lacks scientific rigor and intellectual honesty. It relies heavily on the opinions and projections of Morgan Stanley analysts without providing much evidence or data to support their claims. The article also does not explore the consequences of these price forecasts on those who bear the risks, such as oil-producing countries or consumers. Additionally, the article briefly mentions the substitution of electricity for fossil fuels but does not delve into this topic or provide any meaningful insights or solutions. Overall, the article contains some relevant information but lacks depth and critical analysis.

Financial Relevance: Yes

Financial Markets Impacted: The article provides information on the forecasted lower global crude oil prices, which can impact the energy sector and companies involved in oil production and exploration.

Presence of Extreme Event: No

Nature of Extreme Event: No

Impact Rating of the Extreme Event: No

Justification: The article discusses the forecasted lower global crude oil prices, which can have financial implications for the energy sector and companies involved in oil production and exploration. However, there is no mention of any extreme events or their impact.

www.marketwatch.com

www.marketwatch.com